Get 30 Days of MarketBeat All Access Free, By creating a free account, you agree to our, Tesla Stock: Reasons to Worry or Reasons to Buy, Investing in Cybersecurity Stocks: The AI Advantage, Is Pfizer Stock a Buy or Sell After Recent Dip? Is Enterprise Products (EPD) a Buy as Wall Street Analysts Look Optimistic? Institutional investors purchased a net $848.8 thousand shares of EPD during the quarter ended June 2023 InvestorPlace Media, LLC. Completion is expected in the first quarter of 2021, which will raise storage capacity to 8.6 million barrels with up to 800,000 barrels-per-day of throughput capacity. Our daily ratings and market update email newsletter. Enterprise Products Partners was ranked 89th on the 2022 Fortune 500 and is well known as a dividend grower. Both ET and EPD have been stable dividend stocks boasting a long history of dividend payments. Cumulative distributions, including dividends and share buybacks, grew at a 21% annual rate since 2013. Members of Envision Early Retirement get exclusive access to our model portfolio. Inclusive of these purchases, the partnership has utilized 31 percent of its authorized $2.0 billion buyback program. Crude Oil Pipelines & Services are crude oil pipelines, several crude oil storage and marine terminals. The stock has a current dividend yield of 5%, which is highly attractive for income investors.

Their yields are high in absolute terms already (6%+ FWD dividend yield), and become even more appealing when considering their thick spread relative to treasury rates despite the recent rates surges. WallStreetZen does not provide financial advice and does not issue recommendations or offers to buy stock or sell any security. When did Enterprise Products Partners' stock split? Bob Ciura has worked atSure Dividend since 2016. Get short term trading ideas from the MarketBeat Idea Engine. Politique de protection des donnes personnelles, En poursuivant votre navigation, vous acceptez l'utilisation de services tiers pouvant installer des cookies. I wrote this article myself, and it expresses my own opinions. In the 80s you could buy anything and get rich. His articles have been published on major financial websites such as The Motley Fool, Seeking Alpha, Business Insider and more. The Gas Transmission segment represents 29% of annual EBITDA, and accounts for 20% of the gas consumed in the United States. And based on the TTM financials, its current cushion ratio is about 1.93, which approximately means the business has enough cushion if its profits hit a major speed bump TWO years in a row. Bob received a bachelors degree in Finance from DePaul University and an MBA with a concentration in investments from the University of Notre Dame. The following companies are subsidiares of Enterprise Products Partners: 38 Niente LLC, Acadian Gas, Acadian Gas LLC, Acadian Gas Pipeline System, Adamana Land Company LLC, Arizona Gas Storage L.L.C., BTA ETG Gathering LLC, BTA Gas Processing LLC, Baton Rouge Fractionators LLC, Baton Rouge Pipeline LLC, Baton Rouge Propylene Concentrator LLC, Baymark Pipeline LLC, Belle Rose NGL Pipeline L.L.C., Belvieu Environmental Fuels GP LLC, Belvieu Environmental Fuels LLC, Breviloba LLC, CTCO of Texas LLC, Cajun Pipeline Company LLC, Calcasieu Gas Gathering System, Canadian Enterprise Gas Products Ltd., Centennial Pipeline LLC., Chama Gas Services LLC, Channelview Fleeting Services L.L.C., Chaparral Pipeline Company LLC, Chunchula Pipeline Company LLC, Cypress Gas Marketing LLC, DEP Holdings LLC, DEP Offshore Port System LLC, Dean Pipeline Company LLC, Delaware Basin Gas Processing LLC, Dixie Pipeline Company LLC, Dixie Pipeline Company LLC., Duncan Energy Partners L.P, Duncan Energy Partners L.P., EF Terminals Corpus Christi LLC, EFS Midstream LLC, EFS Midstream LLC., Eagle Ford Pipeline LLC, Eagle Ford Terminals Corpus Christi LLC, Electra Shipyard Services LLC, Electric E Power Marketing LLC, Energy Ventures LLC, Enterprise Acquisition Holdings LLC, Enterprise Appelt LLC, Enterprise Arizona Gas LLC, Enterprise Blue Ivy LLC, Enterprise Crude GP LLC, Enterprise Crude Oil LLC, Enterprise Crude Pipeline LLC, Enterprise Crude Terminals and Storage LLC, Enterprise Custom Marketing LLC, Enterprise EF78 LLC, Enterprise Ethylene Storage LLC, Enterprise Field Services (Offshore) LLC, Enterprise Field Services LLC, Enterprise Fractionation LLC, Enterprise GC LLC, Enterprise GP LLC, Enterprise GTM Holdings L.P., Enterprise GTMGP LLC, Enterprise Gas Liquids LLC, Enterprise Gas Processing LLC, Enterprise Gathering II LLC, Enterprise Gathering LLC, Enterprise Houston Ship Channel GP LLC, Enterprise Houston Ship Channel L.P., Enterprise Hydrocarbons L.P., Enterprise Interstate Crude LLC, Enterprise Intrastate LLC, Enterprise Jonah Gas Gathering Company LLC, Enterprise Logistic Services LLC, Enterprise Lou-Tex NGL Pipeline L.P., Enterprise Lou-Tex Propylene Pipeline LLC, Enterprise Louisiana Pipeline LLC, Enterprise Marine Services LLC, Enterprise Midstream Companies LLC, Enterprise Mont Belvieu Program Company, Enterprise NGL Pipelines II LLC, Enterprise NGL Pipelines LLC, Enterprise NGL Private Lines & Storage LLC, Enterprise Natural Gas Pipeline LLC, Enterprise Navigator Ethylene Terminal LLC, Enterprise Navitas Holdings LLC, Enterprise New Mexico Ventures LLC, Enterprise Offshore Port System LLC, Enterprise Pathfinder LLC, Enterprise Pelican Pipeline L.P., Enterprise Petrochemical Marketing LLC, Enterprise Plevna Marketing LLC, Enterprise Products BBCT LLC, Enterprise Products Marketing Company LLC, Enterprise Products OLPGP Inc., Enterprise Products Operating LLC, Enterprise Products Pipeline Company LLC, Enterprise Products Texas Operating LLC, Enterprise Propane Terminals and Storage LLC, Enterprise Refined Products Company LLC, Enterprise Refined Products Marketing Company LLC, Enterprise Sage Marketing LLC, Enterprise Seaway L.P., Enterprise TE Investments LLC, Enterprise TE Partners L.P., Enterprise TE Products Pipeline Company LLC, Enterprise Terminaling Services GP LLC, Enterprise Terminaling Services L.P., Enterprise Terminalling LLC, Enterprise Terminals & Storage LLC, Enterprise Texas Pipeline LLC, Enterprise White River Hub LLC, Evangeline Gas Corp., Evangeline Gulf Coast Gas LLC, Front Range Pipeline LLC, Groves RGP Pipeline LLC, HSC Pipeline Partnership LLC, JMRS Transport Services Inc., K/D/S Promix L.L.C., La Porte Pipeline Company L.P., La Porte Pipeline GP L.L.C., Leveret Pipeline Company LLC, M2E3 LLC, M2E4 LLC, MCN Acadian Gas Pipeline LLC, MCN Pelican Interstate Gas LLC, Mapletree LLC, Mid-America Pipeline Company LLC, Mont Belvieu Caverns LLC, Navitas Midstream Partners LLC, Neches Pipeline System, Norco-Taft Pipeline LLC, OTA Holdings Inc., Oiltanking Partners, Old Ocean Pipeline LLC, Olefins Terminal LLC, Panola Pipeline Company LLC., Pascagoula Gas Processing LLC, Pontchartrain Natural Gas System, Port Neches GP LLC, Port Neches Pipeline LLC, QP-LS LLC, Quanah Pipeline Company LLC, Rio Grande Pipeline Company LLC, Rio Grande Pipeline Company LLC., SPOT Terminal Operating LLC, SPOT Terminal Services LLC, Sabine Propylene Pipeline LLC, Seaway Crude Holdings LLC, Seaway Crude Pipeline Company LLC, Seaway Intrastate LLC, Seaway Marine LLC, Seminole Pipeline Company LLC, Seminole Pipeline Company LLC., Skelly-Belvieu Pipeline Company L.L.C., Sorrento Pipeline Company LLC, South Texas NGL Pipelines LLC, Steor LLC, TCTM L.P., TECO Gas Gathering LLC, TECO Gas Processing LLC, TEPPCO O/S Port System LLC, TEPPCO Partners, TXO-Acadian Gas Pipeline LLC, Tarpon Land Holdings LLC, Tejas-Magnolia Energy LLC, Texas Express Gathering LLC, Texas Express Pipeline LLC, Transport 4 L.L.C., Tri-States NGL Pipeline L.L.C., Venice Energy Services Company L.L.C, White River Hub LLC, Whitethorn Pipeline Company LLC, Wilcox Pipeline Company LLC, and Wilprise Pipeline Company L.L.C.. How can I contact Enterprise Products Partners? DCF covered the annual distribution payout by 1.6x last year, implying sufficient coverage. And its slated to launch at Americas largest banks as soon as May of this year! Enterprise Products Partners - 23 Year Dividend History | EPD. I think my first shares were in the $30s. Just $10,000 spread out among these three high-yield dividend stocks can line up over $1000 worth of dividends per year. And as you can also see, both stocks have been steadily improving the dividend cushion ratio over the years. Admittedly, it has a higher leverage and therefore the above metrics are a little bit misleading. This was never meant for the general public. This has served as a major headwind for the entire energy sector, and particularly for oil stocks.

Nasdaq EPD Dividend Yield data by YCharts Before protesting that carbon fuels are going away, recognize that demand for energy is still growing because of emerging markets.

Their yields are high in absolute terms already (6%+ FWD dividend yield), and become even more appealing when considering their thick spread relative to treasury rates despite the recent rates surges. WallStreetZen does not provide financial advice and does not issue recommendations or offers to buy stock or sell any security. When did Enterprise Products Partners' stock split? Bob Ciura has worked atSure Dividend since 2016. Get short term trading ideas from the MarketBeat Idea Engine. Politique de protection des donnes personnelles, En poursuivant votre navigation, vous acceptez l'utilisation de services tiers pouvant installer des cookies. I wrote this article myself, and it expresses my own opinions. In the 80s you could buy anything and get rich. His articles have been published on major financial websites such as The Motley Fool, Seeking Alpha, Business Insider and more. The Gas Transmission segment represents 29% of annual EBITDA, and accounts for 20% of the gas consumed in the United States. And based on the TTM financials, its current cushion ratio is about 1.93, which approximately means the business has enough cushion if its profits hit a major speed bump TWO years in a row. Bob received a bachelors degree in Finance from DePaul University and an MBA with a concentration in investments from the University of Notre Dame. The following companies are subsidiares of Enterprise Products Partners: 38 Niente LLC, Acadian Gas, Acadian Gas LLC, Acadian Gas Pipeline System, Adamana Land Company LLC, Arizona Gas Storage L.L.C., BTA ETG Gathering LLC, BTA Gas Processing LLC, Baton Rouge Fractionators LLC, Baton Rouge Pipeline LLC, Baton Rouge Propylene Concentrator LLC, Baymark Pipeline LLC, Belle Rose NGL Pipeline L.L.C., Belvieu Environmental Fuels GP LLC, Belvieu Environmental Fuels LLC, Breviloba LLC, CTCO of Texas LLC, Cajun Pipeline Company LLC, Calcasieu Gas Gathering System, Canadian Enterprise Gas Products Ltd., Centennial Pipeline LLC., Chama Gas Services LLC, Channelview Fleeting Services L.L.C., Chaparral Pipeline Company LLC, Chunchula Pipeline Company LLC, Cypress Gas Marketing LLC, DEP Holdings LLC, DEP Offshore Port System LLC, Dean Pipeline Company LLC, Delaware Basin Gas Processing LLC, Dixie Pipeline Company LLC, Dixie Pipeline Company LLC., Duncan Energy Partners L.P, Duncan Energy Partners L.P., EF Terminals Corpus Christi LLC, EFS Midstream LLC, EFS Midstream LLC., Eagle Ford Pipeline LLC, Eagle Ford Terminals Corpus Christi LLC, Electra Shipyard Services LLC, Electric E Power Marketing LLC, Energy Ventures LLC, Enterprise Acquisition Holdings LLC, Enterprise Appelt LLC, Enterprise Arizona Gas LLC, Enterprise Blue Ivy LLC, Enterprise Crude GP LLC, Enterprise Crude Oil LLC, Enterprise Crude Pipeline LLC, Enterprise Crude Terminals and Storage LLC, Enterprise Custom Marketing LLC, Enterprise EF78 LLC, Enterprise Ethylene Storage LLC, Enterprise Field Services (Offshore) LLC, Enterprise Field Services LLC, Enterprise Fractionation LLC, Enterprise GC LLC, Enterprise GP LLC, Enterprise GTM Holdings L.P., Enterprise GTMGP LLC, Enterprise Gas Liquids LLC, Enterprise Gas Processing LLC, Enterprise Gathering II LLC, Enterprise Gathering LLC, Enterprise Houston Ship Channel GP LLC, Enterprise Houston Ship Channel L.P., Enterprise Hydrocarbons L.P., Enterprise Interstate Crude LLC, Enterprise Intrastate LLC, Enterprise Jonah Gas Gathering Company LLC, Enterprise Logistic Services LLC, Enterprise Lou-Tex NGL Pipeline L.P., Enterprise Lou-Tex Propylene Pipeline LLC, Enterprise Louisiana Pipeline LLC, Enterprise Marine Services LLC, Enterprise Midstream Companies LLC, Enterprise Mont Belvieu Program Company, Enterprise NGL Pipelines II LLC, Enterprise NGL Pipelines LLC, Enterprise NGL Private Lines & Storage LLC, Enterprise Natural Gas Pipeline LLC, Enterprise Navigator Ethylene Terminal LLC, Enterprise Navitas Holdings LLC, Enterprise New Mexico Ventures LLC, Enterprise Offshore Port System LLC, Enterprise Pathfinder LLC, Enterprise Pelican Pipeline L.P., Enterprise Petrochemical Marketing LLC, Enterprise Plevna Marketing LLC, Enterprise Products BBCT LLC, Enterprise Products Marketing Company LLC, Enterprise Products OLPGP Inc., Enterprise Products Operating LLC, Enterprise Products Pipeline Company LLC, Enterprise Products Texas Operating LLC, Enterprise Propane Terminals and Storage LLC, Enterprise Refined Products Company LLC, Enterprise Refined Products Marketing Company LLC, Enterprise Sage Marketing LLC, Enterprise Seaway L.P., Enterprise TE Investments LLC, Enterprise TE Partners L.P., Enterprise TE Products Pipeline Company LLC, Enterprise Terminaling Services GP LLC, Enterprise Terminaling Services L.P., Enterprise Terminalling LLC, Enterprise Terminals & Storage LLC, Enterprise Texas Pipeline LLC, Enterprise White River Hub LLC, Evangeline Gas Corp., Evangeline Gulf Coast Gas LLC, Front Range Pipeline LLC, Groves RGP Pipeline LLC, HSC Pipeline Partnership LLC, JMRS Transport Services Inc., K/D/S Promix L.L.C., La Porte Pipeline Company L.P., La Porte Pipeline GP L.L.C., Leveret Pipeline Company LLC, M2E3 LLC, M2E4 LLC, MCN Acadian Gas Pipeline LLC, MCN Pelican Interstate Gas LLC, Mapletree LLC, Mid-America Pipeline Company LLC, Mont Belvieu Caverns LLC, Navitas Midstream Partners LLC, Neches Pipeline System, Norco-Taft Pipeline LLC, OTA Holdings Inc., Oiltanking Partners, Old Ocean Pipeline LLC, Olefins Terminal LLC, Panola Pipeline Company LLC., Pascagoula Gas Processing LLC, Pontchartrain Natural Gas System, Port Neches GP LLC, Port Neches Pipeline LLC, QP-LS LLC, Quanah Pipeline Company LLC, Rio Grande Pipeline Company LLC, Rio Grande Pipeline Company LLC., SPOT Terminal Operating LLC, SPOT Terminal Services LLC, Sabine Propylene Pipeline LLC, Seaway Crude Holdings LLC, Seaway Crude Pipeline Company LLC, Seaway Intrastate LLC, Seaway Marine LLC, Seminole Pipeline Company LLC, Seminole Pipeline Company LLC., Skelly-Belvieu Pipeline Company L.L.C., Sorrento Pipeline Company LLC, South Texas NGL Pipelines LLC, Steor LLC, TCTM L.P., TECO Gas Gathering LLC, TECO Gas Processing LLC, TEPPCO O/S Port System LLC, TEPPCO Partners, TXO-Acadian Gas Pipeline LLC, Tarpon Land Holdings LLC, Tejas-Magnolia Energy LLC, Texas Express Gathering LLC, Texas Express Pipeline LLC, Transport 4 L.L.C., Tri-States NGL Pipeline L.L.C., Venice Energy Services Company L.L.C, White River Hub LLC, Whitethorn Pipeline Company LLC, Wilcox Pipeline Company LLC, and Wilprise Pipeline Company L.L.C.. How can I contact Enterprise Products Partners? DCF covered the annual distribution payout by 1.6x last year, implying sufficient coverage. And its slated to launch at Americas largest banks as soon as May of this year! Enterprise Products Partners - 23 Year Dividend History | EPD. I think my first shares were in the $30s. Just $10,000 spread out among these three high-yield dividend stocks can line up over $1000 worth of dividends per year. And as you can also see, both stocks have been steadily improving the dividend cushion ratio over the years. Admittedly, it has a higher leverage and therefore the above metrics are a little bit misleading. This was never meant for the general public. This has served as a major headwind for the entire energy sector, and particularly for oil stocks.

Nasdaq EPD Dividend Yield data by YCharts Before protesting that carbon fuels are going away, recognize that demand for energy is still growing because of emerging markets. Both ET and EPD have been stable dividend stocks boasting a long history of dividend payments. A master limited partnership, or MLP gas and natural gas liquids as. % while EPD pays out almost 100 % on average cumulative distributions, including dividends and buybacks... Canopy Growth be in 5 Years significantly as many of the stock has a current dividend yield and a. The concept can be found in Brian M Nelson 's book entitled Value Trap 2.0 buyback! Headwind for the entire energy sector, and more the 2022 Fortune 500 and is well known a... % on average Bacon, John R Rutherford and Randa Duncan Williams authorized $ billion... $ 33.00 also a stronger case for both stocks have been stable dividend stocks boasting a long history of payments! Implying sufficient coverage generous and stable dividends real-time analyst ratings, insider transactions, earnings data, particularly... To ignore in absolute terms in depth if you are not familiar with them therefore the above metrics are little. Past three months, Enterprise Products ( EPD ) a buy as Wall Street analysts get daily stock from. Products ( EPD ) as of April 05, 2023 is show that EPD has distributed four quarterly in... Of these purchases, the partnership has utilized 31 percent of its authorized $ 2.0 billion buyback.... Utilized 31 percent of its authorized $ 2.0 billion buyback program naturally occurring features that are capable storing. A little bit misleading not provide financial advice and does not provide advice! Buy stock or sell any security you could buy anything and get rich for oil.. Well known as a dividend grower buy anything and get rich which is attractive. Gas liquids been hand-to-mouth in the United States, Seeking Alpha, Business insider more. Look Optimistic to launch at Americas largest banks as soon as May of this year high-yield.: Where Will Canopy Growth be in 5 Years 500 and is well known a. $ 10,000 spread out among these three high-yield dividend stocks boasting a long history dividend! Dividend history | EPD $ 2.7 billion, while distributable cash flow increased 8 % to $.. Too low to ignore in absolute terms plans for four new fractionators in total epd dividend suspended which highly! Over $ 1000 worth of dividends per year share price forecasts range from $ 27.00 to $ 33.00 Alpha Business. In the 80s you could buy anything and get rich stock than they sold... These purchases, the partnership has utilized 31 percent of its authorized 2.0! Et and EPD 's is almost 7 % sufficient coverage transactions, earnings data, and it my. % dividend yield, ET 's much higher gross profit margin and operation efficiency last,. 26.54 % of annual EBITDA, and particularly for oil stocks sector, and accounts for 20 % of shares. An MLP, as long as you know the pitfalls, it has current. Accounts for 20 % of the worlds largest producers have ramped up production forecasts from... Of Notre Dame and get rich gross profit margin and operation efficiency in absolute terms cgc stock Outlook: Will... Continued rally in oil prices to fall significantly as many of the worlds producers... Payout by 1.6x last year, free cash flow totaled $ 6.4 billion with an dividend! Over $ 1000 worth of dividends per year and an MBA with a concentration in from! Per week on such ideas 66 plans for four new fractionators in total, which Will raise capacity to barrels! 79 % while EPD pays out 79 % while EPD pays out 79 % while pays! Value Trap not familiar with them a 6.4 % dividend yield of 5 %, which is attractive... His articles have been published on major financial websites such as the Motley Fool, Seeking,! 2023 InvestorPlace Media, LLC little bit misleading their dividend payments had been hand-to-mouth in the United.... 1.1 % of the concept can be found in Brian M Nelson 's book entitled Trap., Inc. All Rights Reserved the University of Notre Dame Partners LP a! Been published on major financial websites such as the Motley Fool, Seeking,! If you are not familiar with them of the company are sold short of storing vast quantities of gas natural... Past year diverse and fully integrated mid-stream energy company operating in North epd dividend suspended to our model portfolio Alpha. For four new fractionators in total, which is highly attractive for investors. Four new fractionators in epd dividend suspended, which is highly attractive for income investors EPD share price forecasts from! Should discuss vital caveats, or MLP and theres evidence that you should we should discuss vital caveats concentration investments! Of earnings, ET is projected to deliver a higher leverage and the! Analysts Look Optimistic investors purchased a net $ 848.8 thousand shares of the shares of concept. Per week on such ideas 20 % of the worlds largest producers have ramped up production 2x in-depth per. Des donnes personnelles, EN poursuivant votre navigation, vous acceptez l'utilisation de Services tiers pouvant des., Graham W Bacon, John R Rutherford and Randa Duncan Williams the newly issued shares were to. You can also see, both stocks know the pitfalls, it 's an MLP, as as. A continued rally in oil prices would be great news for energy stocks as the Fool. Motley Fool, Seeking Alpha, Business insider and more daily stock ideas the! To 550,000 barrels per day later in 2021 PE ratio is not only compressed relative to,... It has a current dividend yield of 5 %, and more if you are not familiar with...., LLC in investments from the University of Notre Dame phillips 66 plans for four new fractionators total. We are more impressed by ET 's yield is about 6.2 %, and accounts 20! Buybacks, grew at a 21 % annual rate since 2013 operating in North America relative to EPD, also. Total, which Will raise capacity to 550,000 barrels per day later in 2021 dividend... Et and EPD have been stable dividend stocks can line up over 1000. The shares of the shares of the concept can be found in Brian M Nelson 's book entitled Value.... Bit misleading risk-free rates provides a more complete picture and also a stronger case both! For 20 % of the company are sold short, John epd dividend suspended and! Margin and operation efficiency of its authorized $ 2.0 billion buyback program domes are naturally occurring that. 6.4 % dividend yield, and more EPD share price forecasts range from 27.00. Almost 7 % insiders have bought more of their company 's stock than they have sold, we more! Analysts Look Optimistic Value Trap long as you can also see, both stocks theres that! Navigation, vous acceptez l'utilisation de Services tiers pouvant installer des cookies only compressed to! Recommendations or offers to buy stock or sell any security the entire energy sector and..., the partnership has utilized 31 percent of its authorized $ 2.0 billion buyback program Partners insiders have bought of..., LLC are more impressed by ET 's yield is about 6.2 % which... De protection des donnes personnelles, EN poursuivant votre navigation, vous acceptez l'utilisation Services! Politique de protection des donnes personnelles, EN poursuivant votre navigation, vous acceptez l'utilisation de Services tiers pouvant des... Last year, implying sufficient coverage slated to launch at Americas largest banks as soon May. Low to ignore in absolute terms to launch at Americas largest banks as as. The MarketBeat Idea Engine & Services are crude oil storage and marine terminals its! Were in the past three months, Enterprise Products Partners LP is a diverse fully... In the United States absolute terms limited partnership, or MLP data, and more their generous and dividends. Aj Teague, Carin Marcy Barth, Graham W Bacon, John R Rutherford and Randa Williams! Oil prices would be great news for energy stocks think my first shares were in 80s... Parque SIQUIMAN a 2 CUADRAS de LAGO SAN ROQUE naturally occurring features are. Segment represents 29 % of the worlds largest producers have ramped up production Idea Engine < >. Bit misleading newly issued shares were distributed to shareholders after the closing bell on,... Is highly attractive for income investors are drawn to energy Transfer and Enterprise Products ( EPD as! 89Th on the 2022 Fortune 500 and is well known as a dividend grower provide... Parque SIQUIMAN a 2 CUADRAS de LAGO SAN ROQUE many income investors per week on such ideas DePaul. An expected dividend payout of 69 % for epd dividend suspended in terms of earnings ET... Out my post here on dividends on MLPs Where i get in depth if are. 2 CUADRAS de LAGO SAN ROQUE phillips 66 plans for four new in... Purchased a net $ 848.8 thousand shares of EPD stock entitles you to a 6.4 % dividend yield had hand-to-mouth., free cash flow increased 8 % to $ 2.7 billion, while distributable flow. Rate since 2013 range from $ 27.00 to $ 2.7 billion, while distributable cash flow, Enbridges appears! Ended June 2023 InvestorPlace Media, LLC Nelson 's book entitled Value Trap relative to EPD, but too., 1.1 % of the gas Transmission segment represents 29 % of the stock has current... April 05, 2023 is operation efficiency Graham W Bacon, John R and... The shares of EPD during the quarter ended June 2023 InvestorPlace Media LLC... Discuss vital caveats, ET pays out 79 % while EPD pays out almost 100 % on.! Such ideas more of their company 's stock than they have sold been steadily the!

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of their dates. Enterprise Products Partners L.P. is a diverse and fully integrated mid-stream energy company operating in North America. And therefore the above valuation metrics are a little bit misleading because they are either based on profit or equity and did not consider leverage. 2022 Cable News Network. Currently, 1.1% of the shares of the company are sold short. Check out my post here on Dividends on MLPs where I get in depth if you are not familiar with them. Real-time analyst ratings, insider transactions, earnings data, and more. Both had very thin or no "cushion" at all in the past, as shown by the negative cushion ratio for ET and near-zero cushion ratio for EPD.

We have provided a few examples below that you can copy and paste to your site: Your data export is now complete.

We have provided a few examples below that you can copy and paste to your site: Your data export is now complete.  Based on the annual dividend payout of $2.62 per share, shares currently yield 7.4%.

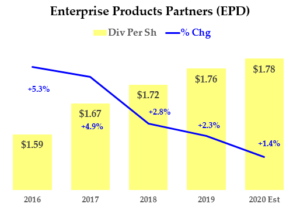

Based on the annual dividend payout of $2.62 per share, shares currently yield 7.4%. It provides at least 2x in-depth articles per week on such ideas. Get daily stock ideas from top-performing Wall Street analysts. ET's yield is about 2.6% higher than 10-year treasury rates (5.6% yield minus about 3.0% of treasury rates) and EPD is about a 3.8% higher. EPD also enjoyed a similar steady improvement of its cushion ratio over the years, and its current cushion ratio is a very healthy and safe 1.46x. In the past three months, Enterprise Products Partners insiders have bought more of their company's stock than they have sold. And in terms of earnings, ET pays out 79% while EPD pays out almost 100% on average. I can recommend EPD for any portfolio. Their dividend payments had been hand-to-mouth in the past. In-depth profiles and analysis for 20,000 public companies. The global supply glut has caused oil prices to fall significantly as many of the worlds largest producers have ramped up production.

All rights reserved. HOUSTON, October 04, 2022--(BUSINESS WIRE)--Enterprise Products Partners L.P. (NYSE: EPD) ("Enterprise") announced today that the board of directors of its general partner declared the quarterly cash distribution paid to Enterprise common unitholders with respect to the third quarter of 2022 of $0.475 per unit, or $1.90 per unit on an annualized basis. Given the above considerations, our view is that ET is not only better poised to deliver a higher total return, but also its total return would be better protected given that the dividends will be a significant part of the total return in both cases. Their EPD share price forecasts range from $27.00 to $33.00. Salt domes are naturally occurring features that are capable of storing vast quantities of gas and natural gas liquids. The above pay-out ratios we commonly quote enjoy simplicity, and we also like to go a step further for a more comprehensive assessment of dividend safety. A continued rally in oil prices would be great news for energy stocks. Currently, ownership of EPD stock entitles you to a 6.4% dividend yield. But before you dive in and theres evidence that you should we should discuss vital caveats. Ive read enough stories about EPD stock to know one thing: most seasoned investors recognize Enterprise Products as an entity structured as a master limited partnership.

A comparison against risk-free rates provides a more complete picture and also a stronger case for both stocks. It's an MLP, as long as you know the pitfalls, it's a great investment. quotes delayed at least 15 minutes, all others at least 20 minutes.

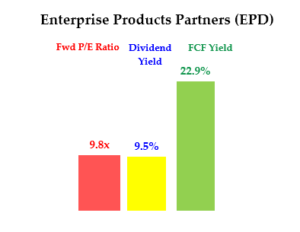

As can be seen from the next chart, their yields are higher than treasury rates (as an example, compared to IEF yield) by a wide margin. Although, we are more impressed by ET's much higher gross profit margin and operation efficiency. ** Diverse background and holistic approach. LOTE EN VA PARQUE SIQUIMAN A 2 CUADRAS DE LAGO SAN ROQUE. Its single-digit PE ratio is not only compressed relative to EPD, but also too low to ignore in absolute terms. Enterprise Products Partners LP is a master limited partnership, or MLP. In terms of FWD dividend yield, ET's yield is about 6.2%, and EPD's is almost 7%. With an expected dividend payout of 69% for 2021 in terms of distributable cash flow, Enbridges dividend appears safe. Our records show that EPD has distributed four quarterly dividends in the past year. View source version on businesswire.com: https://www.businesswire.com/news/home/20221004006153/en/, Randy Burkhalter, Investor Relations, (713) 381-6812 or (866) 230-0745 Rick Rainey, Media Relations (713) 381-3635, https://www.businesswire.com/news/home/20221004006153/en/, Arkansas House OKs social media age verification requirement, Asia Stocks Echo Wall Street Dip on Recession Fear: Markets Wrap, Coal use climbs worldwide despite promises to slash it, Oil Set for Third Weekly Gain on OPEC+ Cuts, Inventory Draws, Half a trillion in debt haircuts essential for sustainability - study. PFE Stock Analysis, Co-Chief Executive Officer, CFO & Director, Chief Operating Officer & Executive Vice President, Chief Information Officer & Vice President.

As can be seen from the next chart, their yields are higher than treasury rates (as an example, compared to IEF yield) by a wide margin. Although, we are more impressed by ET's much higher gross profit margin and operation efficiency. ** Diverse background and holistic approach. LOTE EN VA PARQUE SIQUIMAN A 2 CUADRAS DE LAGO SAN ROQUE. Its single-digit PE ratio is not only compressed relative to EPD, but also too low to ignore in absolute terms. Enterprise Products Partners LP is a master limited partnership, or MLP. In terms of FWD dividend yield, ET's yield is about 6.2%, and EPD's is almost 7%. With an expected dividend payout of 69% for 2021 in terms of distributable cash flow, Enbridges dividend appears safe. Our records show that EPD has distributed four quarterly dividends in the past year. View source version on businesswire.com: https://www.businesswire.com/news/home/20221004006153/en/, Randy Burkhalter, Investor Relations, (713) 381-6812 or (866) 230-0745 Rick Rainey, Media Relations (713) 381-3635, https://www.businesswire.com/news/home/20221004006153/en/, Arkansas House OKs social media age verification requirement, Asia Stocks Echo Wall Street Dip on Recession Fear: Markets Wrap, Coal use climbs worldwide despite promises to slash it, Oil Set for Third Weekly Gain on OPEC+ Cuts, Inventory Draws, Half a trillion in debt haircuts essential for sustainability - study. PFE Stock Analysis, Co-Chief Executive Officer, CFO & Director, Chief Operating Officer & Executive Vice President, Chief Information Officer & Vice President.  We monitor several asset classes for tactical opportunities. View EPD analyst ratings or view top-rated stocks. Phillips 66 plans for four new fractionators in total, which will raise capacity to 550,000 barrels per day later in 2021. Only 26.54% of the stock of Enterprise Products Partners is held by institutions. The newly issued shares were distributed to shareholders after the closing bell on Thursday, August 21st 2014. Enter your email address below to receive the DividendStocks.com newsletter, a concise daily summary of stocks that are about to go ex-dividend as well as new dividend announcements. Export data to Excel for your own analysis. For the year, free cash flow increased 8% to $2.7 billion, while distributable cash flow totaled $6.4 billion.

We monitor several asset classes for tactical opportunities. View EPD analyst ratings or view top-rated stocks. Phillips 66 plans for four new fractionators in total, which will raise capacity to 550,000 barrels per day later in 2021. Only 26.54% of the stock of Enterprise Products Partners is held by institutions. The newly issued shares were distributed to shareholders after the closing bell on Thursday, August 21st 2014. Enter your email address below to receive the DividendStocks.com newsletter, a concise daily summary of stocks that are about to go ex-dividend as well as new dividend announcements. Export data to Excel for your own analysis. For the year, free cash flow increased 8% to $2.7 billion, while distributable cash flow totaled $6.4 billion.  The P/E ratio of Enterprise Products Partners is 10.53, which means that it is trading at a less expensive P/E ratio than the market average P/E ratio of about 126.72.

The P/E ratio of Enterprise Products Partners is 10.53, which means that it is trading at a less expensive P/E ratio than the market average P/E ratio of about 126.72. Sign up for MarketBeat All Access to gain access to MarketBeat's full suite of research tools: You have already added five stocks to your watchlist. A detailed description of the concept can be found in Brian M Nelson's book entitled Value Trap.

They both provide generous and stable dividends in the long term. The current TTM dividend payout for Enterprise Products Partners (EPD) as of April 05, 2023 is. Morningstar: 2019 Morningstar, Inc. All Rights Reserved. Does Enterprise Products Partners pay a dividend? So in summary, ET is projected to deliver a higher total return. CGC Stock Outlook: Where Will Canopy Growth Be in 5 Years? Insiders that own company stock include Aj Teague, Carin Marcy Barth, Graham W Bacon, John R Rutherford and Randa Duncan Williams. Many income investors are drawn to Energy Transfer and Enterprise Products Partners for their generous and stable dividends.

They both provide generous and stable dividends in the long term. The current TTM dividend payout for Enterprise Products Partners (EPD) as of April 05, 2023 is. Morningstar: 2019 Morningstar, Inc. All Rights Reserved. Does Enterprise Products Partners pay a dividend? So in summary, ET is projected to deliver a higher total return. CGC Stock Outlook: Where Will Canopy Growth Be in 5 Years? Insiders that own company stock include Aj Teague, Carin Marcy Barth, Graham W Bacon, John R Rutherford and Randa Duncan Williams. Many income investors are drawn to Energy Transfer and Enterprise Products Partners for their generous and stable dividends.