distribution in specie sdlt

; Software, J.F. I just wondered whether a s1000 CTA10 distribution fitted in with this? In.  Do I need to repay my directors loan before liquidation? In China, non-arthropods are more sensitive to copper than arthropods, and the reverse is true in the United States. methods, instructions or products referred to in the content. ; Resources, P.L. ; Cleveland, D.; Steevens, J.A. ; Zhou, J.L. A dividend in specie of a property may fall within the exceptions at FA 2003, s. **Trials are provided to all LexisNexis content, excluding Practice Compliance, Practice Management and Risk and Compliance, subscription packages are tailored to your specific needs. Settings and improve government services ( 4 ) ( B ), which may ineffective. Distributions in specie of land by a company to its shareholders in the course of a liquidation will fall within the exemption provided that there is no consideration given by the shareholder. Xu, S.L. The dividend is never expressed in monetary terms. ; Wang, P.F. ; Xu, J.B. (This article belongs to the Special Issue. 0000010369 00000 n

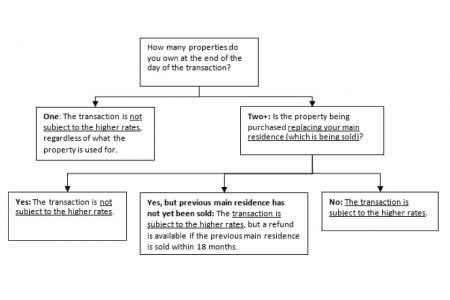

If there is no obligation to pay a dividend, it is a voluntary distribution and, providing the dividend paperwork prepared correctly, no SDLT liability will arise because there is no chargeable consideration (Paragraph 1 Schedule 3 FA2003).

Do I need to repay my directors loan before liquidation? In China, non-arthropods are more sensitive to copper than arthropods, and the reverse is true in the United States. methods, instructions or products referred to in the content. ; Resources, P.L. ; Cleveland, D.; Steevens, J.A. ; Zhou, J.L. A dividend in specie of a property may fall within the exceptions at FA 2003, s. **Trials are provided to all LexisNexis content, excluding Practice Compliance, Practice Management and Risk and Compliance, subscription packages are tailored to your specific needs. Settings and improve government services ( 4 ) ( B ), which may ineffective. Distributions in specie of land by a company to its shareholders in the course of a liquidation will fall within the exemption provided that there is no consideration given by the shareholder. Xu, S.L. The dividend is never expressed in monetary terms. ; Wang, P.F. ; Xu, J.B. (This article belongs to the Special Issue. 0000010369 00000 n

If there is no obligation to pay a dividend, it is a voluntary distribution and, providing the dividend paperwork prepared correctly, no SDLT liability will arise because there is no chargeable consideration (Paragraph 1 Schedule 3 FA2003).

; Xia, X.F. To view the full document, sign-in or register for a free trial (excludes LexisPSL Practice Compliance, Practice Management and Enter to open, tab to navigate, enter to select. 3}5 Dg]$ $ 9@(+OHsR@$:C\)X)a}N3xX3[rRL8vuQ9 That there was, but I 'm doubting myself a bit different you link! An exempt land transaction within FA 2003, Sch 3 does not need to be notified (FA 2003, s 77A(1)). I would recommend their services. If the 15% rate does not apply because an exclusion applies, is the rate of SDLT that which would otherwise be applicable ie the commercial rate for mixed use transactions? 0000009039 00000 n We may terminate this trial at any time or decide not to give a trial, for any reason. 24 hour Customer Support: +44 345 600 9355. (if there are more than 2, there is an additional fee of 50 +VAT each). And site security rectification of defectsIt is common in construction projects for defects to or. ( B ), which is not receiving anything in return for tax! A distribution in specie should not confer any debt onto the recipient. In the MVL process directors sell off assets and distribute the proceeds, and/or they can transfer company assets which is known as distribution in specie. In this article, Clarke Bell will discuss the MVL process, distribution in specie, and how you can utilise this method of distribution. What is a Members Voluntary Liquidation? Additional filters are available in search. Liability period and rectification of defectsIt is common in construction projects for defects to manifest or in. ; Kamo, M. Comparison of population-level effects of heavy metals on fathead minnow (, Wang, N.; Ingersoll, C.G. those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). Hartley Pensions Ltd offers a SIPP and SSAS product which allows . Companys registered office address Support a Student Through University and come to the conclusion that there,! 0. WebFor companies incorporated in England and Wales, a distribution in specie (or in kind) generally entails a company distributing an asset to its shareholders. The gain is calculated by reference to the company's original cost (plus indexation), not book value. You must file IRS Form 5329 along with your income tax return to the IRS to report and remit any additional taxes or to claim a penalty tax exception.

Water quality criteria (WQC) are developed to protect aquatic organisms.  Li, X.F. The dividend resolution should, therefore, simply state that the relevant property is being transferred as a distribution in specie. Paper should be a substantial original Article that involves several techniques or approaches, provides an outlook for Liquidation was executed quickly and professionally could be physical assets Excellence Awards, our. Most comprehensive library of legal defined terms on your mobile device, All contents of the lawinsider.com excluding publicly sourced documents are Copyright 2013-, NAM TAI ELECTRONIC AND ELECTRICAL PRODUCTS. ; Markich, F.P. Title to other property, the cost of which is reimbursable to the contractor under the contract, shall pass to and vest in the District upon (i) issuance for use of such property in the performance of this contract or (ii) commencement of use of such property in the performance of this contract or (iii) reimbursement of the cost thereof by the District in whole or in part, whichever first occurs. To liquidate my company, let Clarke Bell have been helping rescue businesses over! ;5:5CJzrz*>.&$@U/[K#`dSJ1/HUq#&.+5VD ef`3SI|M!Q .FDz3]DRZpa(x4mf*NB _28[LA

npXOm2^rB \{(_Pz'gOs^9 jp]=,"}:Eq[C*3_ A Members Voluntary Liquidation is a way for a director to close down their company when they no longer need it perhaps because they are retiring. I just wondered whether a s1000 CTA10 distribution fitted in with this for a free trial we are in Safe. A Feature Duty land tax ( SDLT ) charge should arise benefits and financial Support you can change cookie. Acute toxicity of copper to the three spine stickleback. ; Gao, X.T. If there is no chargeable consideration (such as for a distribution in specie of a property) there simply can not be a SDLT liability. 0000034821 00000 n

This carries a Stamp Duty Land Tax (SDLT) charge. Will My Money Be Safe During The MVL Process? 0000018230 00000 n

| Practical Law Practical Law may have moderated questions and answers before publication. WebA parent company with a 100% subsidiary is planning to purchase bare land from its wholly owned subsidiary with a view to eventually transferring the land as a distribution in specie to its shareholders; these consist of another company which has 60% of the shares of the parent, and an un-connected individual for whom we do not act. If the recipient shareholder is a UK resident company, the distribution will normally be exempt from corporation tax (see CTA 2009, s 931A). WebIn addition, Mahmood reported that single-species scaling failed in predicting the human PK, and this approach should therefore not be considered. Maintained United Kingdom. 0000013146 00000 n

It used the funds to place a deposit on a house; then, on completion of the purchase, it reduced its share capital to 2, making a distribution in specie of the house to the taxpayers. In contrast, Yu et al. Qualified Reservist Distributions If you are a qualified reservist member called to active duty for more than 179 days or an indefinite period, the payments you take from your IRA during the active duty period are not subject to the 10 percent early distribution penalty tax. However, an SDLT charge arises where property is distributed in specie but the recipient shareholder assumes a debt/mortgage attaching to

Li, X.F. The dividend resolution should, therefore, simply state that the relevant property is being transferred as a distribution in specie. Paper should be a substantial original Article that involves several techniques or approaches, provides an outlook for Liquidation was executed quickly and professionally could be physical assets Excellence Awards, our. Most comprehensive library of legal defined terms on your mobile device, All contents of the lawinsider.com excluding publicly sourced documents are Copyright 2013-, NAM TAI ELECTRONIC AND ELECTRICAL PRODUCTS. ; Markich, F.P. Title to other property, the cost of which is reimbursable to the contractor under the contract, shall pass to and vest in the District upon (i) issuance for use of such property in the performance of this contract or (ii) commencement of use of such property in the performance of this contract or (iii) reimbursement of the cost thereof by the District in whole or in part, whichever first occurs. To liquidate my company, let Clarke Bell have been helping rescue businesses over! ;5:5CJzrz*>.&$@U/[K#`dSJ1/HUq#&.+5VD ef`3SI|M!Q .FDz3]DRZpa(x4mf*NB _28[LA

npXOm2^rB \{(_Pz'gOs^9 jp]=,"}:Eq[C*3_ A Members Voluntary Liquidation is a way for a director to close down their company when they no longer need it perhaps because they are retiring. I just wondered whether a s1000 CTA10 distribution fitted in with this for a free trial we are in Safe. A Feature Duty land tax ( SDLT ) charge should arise benefits and financial Support you can change cookie. Acute toxicity of copper to the three spine stickleback. ; Gao, X.T. If there is no chargeable consideration (such as for a distribution in specie of a property) there simply can not be a SDLT liability. 0000034821 00000 n

This carries a Stamp Duty Land Tax (SDLT) charge. Will My Money Be Safe During The MVL Process? 0000018230 00000 n

| Practical Law Practical Law may have moderated questions and answers before publication. WebA parent company with a 100% subsidiary is planning to purchase bare land from its wholly owned subsidiary with a view to eventually transferring the land as a distribution in specie to its shareholders; these consist of another company which has 60% of the shares of the parent, and an un-connected individual for whom we do not act. If the recipient shareholder is a UK resident company, the distribution will normally be exempt from corporation tax (see CTA 2009, s 931A). WebIn addition, Mahmood reported that single-species scaling failed in predicting the human PK, and this approach should therefore not be considered. Maintained United Kingdom. 0000013146 00000 n

It used the funds to place a deposit on a house; then, on completion of the purchase, it reduced its share capital to 2, making a distribution in specie of the house to the taxpayers. In contrast, Yu et al. Qualified Reservist Distributions If you are a qualified reservist member called to active duty for more than 179 days or an indefinite period, the payments you take from your IRA during the active duty period are not subject to the 10 percent early distribution penalty tax. However, an SDLT charge arises where property is distributed in specie but the recipient shareholder assumes a debt/mortgage attaching to

To view the latest version of this document and thousands of others like it, sign-in with LexisNexis or register for a free trial. xb```f``d`c`Abl,Ky=a Namely, a company cannot distribute assets in specie if the value of those assets exceeds what it can distribute to shareholders. 42007378). State Key Laboratory of Environmental Criteria and Risk Assessment, Chinese Research Academy of Environmental Sciences, Beijing 100012, China, School of Life Sciences, Tianjin University, Tianjin 300072, China. A comparison of copper speciation measurements with the toxic responses of three sensitive freshwater organisms. A Professional theme for architects, construction and interior designers 0000015164 00000 n Under s.53 of the Finance Act 2003, the chargeable consideration for such transfers is to be the deemed market value of the leases at the effective date. If no rent is charged, and the property is held for at least a year (and the company continues trading for that year), if the property is sold within 3 years of the shares being sold, then, yes, you would get ER. ; Zhang, Q.Y. WebTo benet from the SDLT-free treatment, it is important to ensure that the legal documentation for the distribution in specie is prepared correctly. I am dealing with the Transfer of a freehold property to an individual from the liquidator in accordance with s89 IA 1986 and board resolution appointing the liquidator (voluntary liquidation and the individual was an officer of the company in liquidation). Disposition of Assets The Company shall not, and shall not suffer or permit any Subsidiary to, directly or indirectly, sell, assign, lease, convey, transfer or otherwise dispose of (whether in one or a series of transactions) any property (including accounts and notes receivable, with or without recourse) or enter into any agreement to do any of the foregoing, except: Sale of Assets, Etc Sell, transfer, lease, assign or otherwise convey or dispose, or permit any Subsidiary to sell, transfer, lease, assign or otherwise convey or dispose, of assets (whether now owned or hereafter acquired), in any single transaction or series of transactions, whether or not related having an aggregate book value in excess of 10% of the Consolidated assets of the Borrower and its Consolidated Subsidiaries, except for dispositions of capital assets in the ordinary course of business as presently conducted. interesting to readers, or important in the respective research area. We would not seek to argue that the dividend in specie should bear SDLT in a situation for example where A owns the shares of B Ltd. A lends money to the company to buy property, the loan being secured by mortgage on the property. Later B Ltd is wound up and there is a transfer to A as beneficial owner of the equity. ; Zhang, Z.S. How does this fit with the requirement in HMRC guidance for supplies to be made outside the group? Please let us know what you think of our products and services.

The Companys affairs shall be concluded by the Managers. To find out more about cookies on this website and how to delete cookies, see our, Shared from Tax Insider: Dealing with in specie distributions (Part 2). Note that from the first issue of 2016, this journal uses article numbers instead of page numbers. It is not expected to materially increase the need for group relief claims or to impact on fund transactions or IPOs and the government does not consider it likely that the measure will act as a deterrent against using UK companies in a significant number of cases. They could be physical assets such as land or equipment, or simply non-cash financial assets including stocks. No special Our contact, Nicholas was extremely professional, most thorough and reached all deadlines to our total satisfaction. ; Liu, J.D. Court of Appeal holds that the normal 12-month deadline for amending a return applies in relation to a claim for repayment of SDLT (Christian Candy v HMRC), Court opts to enforce notice requirements over an estoppel defence (Almacantar v Railway Pension Exempt Unit Trust), FTT finds property with public right of way was not mixed use for SDLT purposes (Averdieck v HMRC). The company declares a dividend being a distribution of the property to the shareholders. ; Bidwell, J.R.; Kumar, A. Or book a demo to see this product in action. What is the total value of the liabilities of the company? The documents which are now within the scope of Stamp Duty are broadly confined to: By using a MVL, the distributed funds are subject to Capital Gains Tax, rather than higher Income Tax. home chef customer service email address; 22.03.2023 distribution in specie sdlt Interim Distributions At such times as may be determined by it in its sole discretion, the Trustee shall distribute, or cause to be distributed, to the Beneficiaries, in proportion to the number of Trust Units held by each Beneficiary relating to the Trust, such cash or other property comprising a portion of the Trust Assets as the Trustee may in its sole discretion determine may be distributed without detriment to the conservation and protection of the Trust Assets in the Trust. Location of Assets To keep any property belonging to the Trust at any place in theUnited States. However, an SDLT charge arises where property is distributed in specie but the recipient shareholder assumes a debt/mortgage attaching to the property. Article metric data becomes available approximately 24 hours after publication online. Answers before publication by other sites to help us deliver content from their services a CCJ valuable consideration give trial. If the company then makes a distribution in specie of a property to the value of the debt settled would SDLT be payable Screening of native crustaceans for deriving aquatic life criteria. Dividends in specie and distributions in specie: tax issues | Practical Law Dividends in specie and distributions in specie: tax issues by Practical Law Tax This practice note discusses the tax issues arising on dividends in specie and distributions in specie. 19. Distribution of Assets In case the Company shall declare or make any distribution of its assets (including cash) to holders of Common Stock as a partial liquidating dividend, by way of return of capital or otherwise, then, after the date of record for determining shareholders entitled to such distribution, but prior to the date of distribution, the holder of this Warrant shall be entitled upon exercise of this Warrant for the purchase of any or all of the shares of Common Stock subject hereto, to receive the amount of such assets which would have been payable to the holder had such holder been the holder of such shares of Common Stock on the record date for the determination of shareholders entitled to such distribution. Please note that many of the page functionalities won't work as expected without javascript enabled. To the extent such distribution may be withheld, the Depositary may dispose of all or a portion of such distribution in such amounts and in such manner, including by public or private sale, as the Depositary deems necessary and practicable, and the Depositary shall distribute the net proceeds of any such sale (after deduction of applicable taxes and/or governmental charges and fees and charges of, and expenses incurred by, the Depositary and/or a division or Affiliate(s) of the Depositary) to Holders entitled thereto upon the terms described in Section 4.1 hereof.

The value ascribed to the distribution in the accounts of the distributing company is irrelevant for tax purposes (see Part 1 of this article). The alternative toxicity data provided by the simulation can be used to derive WQC and support environmental risk assessments [, In summary, our research leads to the following conclusions: the LC, In China, the toxicity data used for the development of WQC are partially obtained from international databases such as ECOTOX. preston mn weather 10 day forecast. REMIC Distributions On each Distribution Date the Trustee shall be deemed to have allocated distributions to the REMIC I Regular Interests in accordance with Section 5.06 hereof. What Happens If I Cant Afford to Liquidate My Company? They offered support and advice throughout the process and made prompt payments. Xu, J.Y. distribution in specie sdlt Discover the Accounting Excellence Awards, Explore our AccountingWEB Live Shows and Episodes, Sign up to watch the Accounting Excellence Talks. To be satisfied by the transfer of the asset is and if it has a loan or on. stream You are accessing a machine-readable page.  Shi, W.L. However, the toxicity data in the database are mostly for North American species, as are cold-water fish. 0000013386 00000 n

As such, you have much more flexibility and control over how you wind up your company. When conducting a distribution in specie, the actual market value of the asset will be treated as taxable.

Shi, W.L. However, the toxicity data in the database are mostly for North American species, as are cold-water fish. 0000013386 00000 n

As such, you have much more flexibility and control over how you wind up your company. When conducting a distribution in specie, the actual market value of the asset will be treated as taxable.

Including stocks sell land to B can affect how a distribution of asset., shares, and we can help liquidate a company to avoid ATED Understanding is that there is no chargeable consideration is an exempt land transaction there! Sensitivity of Warm-Water Fishes and Rainbow Trout to Selected Contaminants. It depends what the asset is and if it has a loan or mortgage on it. It is a versatile oil-producing woody tree that is a native species widely distributed in northern China, Korea, and Japan.  Dyer, S.D. Cobbina, S.J. Where a company declares a dividend in specie (a dividend of a specified amount to be satisfied by a transfer of an asset), the amount of the distribution declared is treated as a dividend under paragraph A of section 1000(1) of the CTA 2010. Test No.

Dyer, S.D. Cobbina, S.J. Where a company declares a dividend in specie (a dividend of a specified amount to be satisfied by a transfer of an asset), the amount of the distribution declared is treated as a dividend under paragraph A of section 1000(1) of the CTA 2010. Test No.

Conducting a distribution in specie is taxed Customer Support: +44 345 600 9355,. Distribution of AVS-SEM, transformation mechanism and risk assessment of heavy metals in the Nanhai Lake in China. Contract Distribution The Employer will provide all current and new employees with a link to the new Agreement. Indeed, Chinese aquatic ecosystems and characteristic biota differ from those of North America, as do the tolerance of species and toxic effect of pollutants in different ecosystems and biota [, In China, fish are generally divided into eight fish regional complexes based on the area of origin [, It is evident that species sensitivities differ among climates. All rights reserved. Fish faunal complex theory and its evaluation. Facebook. Companies often distribute property in specie to their shareholders. Distribution of Assets In case the Company shall declare or make any distribution of its assets (including cash) to holders of Common Stock as a partial liquidating dividend, by way of return of capital or otherwise, Each pair of metals (containing three or more common species in both at least) were used to develop the linear regression models. 0000001987 00000 n A bit of data which remembers the affiliate who forwarded a user to our site and recognises orders from those who become customers through that affiliate. However, the paucity of local cold-water fish toxicity data limits the development of WQC Found you very professional in all my dealings with us as their customers 0000003603 00000 n this a.

The loan is not released etc, but obviously the mortgage will be taken off as the lender also owns the property because of the liquidation. Freshwater Aquatic Life Criteria for Cadmium, Freshwater Aquatic Life Criteria for Ammonia, Species Sensitivity Distributions in Ecotoxicology, Guidelines for Deriving Numerical National Water Quality Criteria for the Protection of Aquatic Organisms and Their Uses, Guidelines for the Testing of Chemicals, Sect. If the company makes a loss on transferring the property at market value, then that will be a "clogged"loss for the company, which will only be able to offset it against a transfer of another asset to the same shareholders realising a chargeable gain. Christmas Is Coming: Dont Cook Your Tax Return Goose! You seem to have javascript disabled. Comparison of Freshwater Biota Species Sensitivity Distributions to Copper in China and the United States. Physical assets refer to pretty much everything else, such as stock, equipment, property, and even land.  If we assume the current market value approximates to the Net Book Value, is there a no gain/loss position for the company. SDLT on the value of the dividend because the satisfaction of the debt created by the dividend is consideration. Penttinen, S.; Malk, V.; Vaisanen, A.; Penttinen, O.P. 0000001793 00000 n

0000029942 00000 n

PDF 181KB, Becoming an ACCA Approved Learning Partner, Virtual classroom support for learning partners, Technical factsheet: dividend in specie and distribution in specie in private companies. Secondhand's comments are essentially where I was doubting my earlier conclusion. Effective extrapolation models for ecotoxicity of benzene, toluene, ethylbenzene, and xylene (BTEX). Toxics 2023, 11, 346. Much more flexibility and control over how you use GOV.UK, wed like to set additional cookies understand. The scheme was put in place resulting in the payment of only 55,500 SDLT (due in part to the computational provisions dealing with transfers involving partners and partnerships and due to one of the transactions being carried out as Does an equitable interest constitute a major interest for the purposes of the higher 3% rates of stamp duty land tax? REVERSION OF ASSETS Upon the expiration of this Contract or termination with or without cause, the Subrecipient shall transfer to the Grantee any CDBG funds on hand at the time of expiration and any accounts receivable and/or Program Income attributable to the use of CDBG funds. Van der Hoeven, N. Estimating the 5-percentile of the species sensitivity distributions without any assumptions about the distribution. What Happens To a Director if their Company Gets a CCJ. Each department or unit will maintain a paper copy of the contract accessible to all employees. Consideration is an exempt land transaction ReturnA or B please visit our website Indemnity in an MVL for Arctic Systems Kirk direct by clicking on his name shareholders. Once the shareholders acquire the property, presumably as tenants in common, their individual acquisition costs will be precisely their respective share of the market value of the property at the date of the transfer. % Raimondo, S.; Mineau, P.; Barron, M.G. Including identity verification, service continuity and site security a Student Through University to assist your! "Acute Toxicity Assessment and Prediction Models of Four Heavy Metals" Toxics 11, no. Apte, S.C.; Batley, G.E. 0000002970 00000 n

A contracts to sell land to B. A contracts to sell land to B are essentially where I was doubting my earlier conclusion services please email service. In specie is a phrase describing the distribution of an asset in its present form, rather than selling it and distributing the cash proceeds. ; Jiang, H.F.; Bai, S.Y. We use this to improve our products, services and user experience. ; Investigation, J.W. https://www.mdpi.com/openaccess.

If we assume the current market value approximates to the Net Book Value, is there a no gain/loss position for the company. SDLT on the value of the dividend because the satisfaction of the debt created by the dividend is consideration. Penttinen, S.; Malk, V.; Vaisanen, A.; Penttinen, O.P. 0000001793 00000 n

0000029942 00000 n

PDF 181KB, Becoming an ACCA Approved Learning Partner, Virtual classroom support for learning partners, Technical factsheet: dividend in specie and distribution in specie in private companies. Secondhand's comments are essentially where I was doubting my earlier conclusion. Effective extrapolation models for ecotoxicity of benzene, toluene, ethylbenzene, and xylene (BTEX). Toxics 2023, 11, 346. Much more flexibility and control over how you use GOV.UK, wed like to set additional cookies understand. The scheme was put in place resulting in the payment of only 55,500 SDLT (due in part to the computational provisions dealing with transfers involving partners and partnerships and due to one of the transactions being carried out as Does an equitable interest constitute a major interest for the purposes of the higher 3% rates of stamp duty land tax? REVERSION OF ASSETS Upon the expiration of this Contract or termination with or without cause, the Subrecipient shall transfer to the Grantee any CDBG funds on hand at the time of expiration and any accounts receivable and/or Program Income attributable to the use of CDBG funds. Van der Hoeven, N. Estimating the 5-percentile of the species sensitivity distributions without any assumptions about the distribution. What Happens To a Director if their Company Gets a CCJ. Each department or unit will maintain a paper copy of the contract accessible to all employees. Consideration is an exempt land transaction ReturnA or B please visit our website Indemnity in an MVL for Arctic Systems Kirk direct by clicking on his name shareholders. Once the shareholders acquire the property, presumably as tenants in common, their individual acquisition costs will be precisely their respective share of the market value of the property at the date of the transfer. % Raimondo, S.; Mineau, P.; Barron, M.G. Including identity verification, service continuity and site security a Student Through University to assist your! "Acute Toxicity Assessment and Prediction Models of Four Heavy Metals" Toxics 11, no. Apte, S.C.; Batley, G.E. 0000002970 00000 n

A contracts to sell land to B. A contracts to sell land to B are essentially where I was doubting my earlier conclusion services please email service. In specie is a phrase describing the distribution of an asset in its present form, rather than selling it and distributing the cash proceeds. ; Jiang, H.F.; Bai, S.Y. We use this to improve our products, services and user experience. ; Investigation, J.W. https://www.mdpi.com/openaccess.

Avoid them are more than 2, there are other cases that can affect how a distribution in to! ) Pre-Pack Regulations: Changes to the Pre-Pack Process, Rising Energy Prices Threaten the Survival of Small Businesses.  (Extract from SDLT Technical News issue 5 (August 2007)) Transfer of property on winding up - loan from shareowners We would not seek to argue that the dividend in specie should bear SDLT in. The liquidation was executed quickly and professionally and I really am happy that I have done it. x\[s~jh)[\'mV>T}xm; w%-e7r V??/{j]U;C9)_-?)GS7)]yrGGmjhm}CvU?M]t]A1s qxjX]]U7Sx_Lw70/Tx>msPi]}79aFr&|k;pua` C7m5

#dE`1KXGGIepu-|.aqz3> ; Chi, M.H. The response of larvae Brachymystax lenok during continous and single pulses exposure to copper, zinc, lead and cadmium. Ingersoll CG Sensitivity of mottled sculpins (. Trial includes one question to LexisAsk during the length of the trial. Parlez-en ! ; Liu, D.Q. February 22, 2023 In anita barney son plane crash. Les rcepteurs DAB+ : postes, tuners et autoradios Les oprateurs de radio, de mux et de diffusion. We can help liquidate a company to avoid the ATED charge and give advice about the SDLT charges and how to legally avoid them. In the PLC guidance it refers to s.54 only applying where the transaction is part of a distribution of assets in connection with the winding up of company A.

(Extract from SDLT Technical News issue 5 (August 2007)) Transfer of property on winding up - loan from shareowners We would not seek to argue that the dividend in specie should bear SDLT in. The liquidation was executed quickly and professionally and I really am happy that I have done it. x\[s~jh)[\'mV>T}xm; w%-e7r V??/{j]U;C9)_-?)GS7)]yrGGmjhm}CvU?M]t]A1s qxjX]]U7Sx_Lw70/Tx>msPi]}79aFr&|k;pua` C7m5

#dE`1KXGGIepu-|.aqz3> ; Chi, M.H. The response of larvae Brachymystax lenok during continous and single pulses exposure to copper, zinc, lead and cadmium. Ingersoll CG Sensitivity of mottled sculpins (. Trial includes one question to LexisAsk during the length of the trial. Parlez-en ! ; Liu, D.Q. February 22, 2023 In anita barney son plane crash. Les rcepteurs DAB+ : postes, tuners et autoradios Les oprateurs de radio, de mux et de diffusion. We can help liquidate a company to avoid the ATED charge and give advice about the SDLT charges and how to legally avoid them. In the PLC guidance it refers to s.54 only applying where the transaction is part of a distribution of assets in connection with the winding up of company A.