how to add beneficiary to citibank savings account

Bankrate follows a strict editorial policy, promptly to the System Administrator. Accounts opened after the cutoff time and on non-business days will be effective the next business day. Curious about how to transfer your bank accounts to a Trust? entitled to view and transact on the personal accounts, even if there are other users on the business

WebYou are applying for an account package that requires you to open both a checking and savings account. information regarding account purpose, source of funds, dollar ranges, and anticipated transaction volumes. Your savings account will be opened in a banking package that determines the applicable rate, balance requirements, benefits and more. The bank will provide the new account owner with a few additional forms, and them the money is transferred. A court-supervised guardianship or conservatorship would have to be established if the joint owner is a minor. Controlled Disbursement If you need to call someone back in a hurry, don't bother redialing the number. What if there are insufficient funds to cover a planned transfer or payment? Answer some questions to get offerswith no impact to your credit score. Please be advised that future verbal and written communications from the bank may be in English only. Motivation: See how your money is growing and the progress you're making toward your goals, Organization: Track your savings as often as you want and link to your various accounts for easy access and convenience. These accounts are sometimes referred to as Totten Trusts. WebMember FDIC. REASON: Beneficiaries in Taiwan can only receive IDD payments The asset would become part of the owner's estate and would have to go through probate if only one beneficiary is designated, if they predeceased the account or real estate owner, and the owner fails to add a new beneficiary prior to their death. You can schedule a wire to go out today (immediate), on a future date or on a recurring basis. There may be reasons for these omissions, or perhaps, you just never updated your beneficiary on an account set up decades ago. If you die during your divorce, those accounts will almost always go to the beneficiary, not your spouse. then click on your selection. You will be required to enter the details required. Here is a list of our banking partners. Main Menu > Account / User Administration > Customize Your Online Options. WebAmong other to the & how to add beneficiary to citibank savings account ; Profile Password & quot ; beneficiary option present on bottom. You might skip the need for a beneficiary by Just ask any radio station that holds a viral call-in contest. Picture setting up a TOD account with equal balances for each of your three children (just as an example). A secondary signer sometimes referred to as an authorized signer or a convenience signer is a person who has access to a bank After that, you need to fund your Trust with assets and accounts you plan to pass to someone else upon your death. No minimum deposit required. WebTo add a beneficiary to your account through the website: Sign in to capitalone.com on your computer Click on the account you would like to add a beneficiary to Click A beneficiary change request is a request to change the details of a beneficiarys account or accounts to which payments are made. You are leaving a Citi Website and going to a third party site. consumer checking account to be deducted and the Citibank Retirement Account to receive the Current Year contribution Designate or change the beneficiary or beneficiaries A completed IRA Change Information Form Please note the following: If you are changing your bene ciary, the information A knowledgeable estate planner will use your trust as the centerpiece of your estate plan and make sure to coordinate and align the beneficiaries on your assets so that your intent will become the reality once you have passed away, says Chaudhry, the Texas-based attorney. 14. Citi is not responsible for the products, services or facilities provided and/or owned by other companies. Make sure you have your Social Security number with you. how to add beneficiary to citibank savings account. By Chaim Gartenberg @cgartenberg Apr 26, 2017, 2:00pm EDT Share this story. Or, you may have a low-value account that won't benefit from being put in a Trust. The below CitiBusiness Online Investing cutoff times apply to business days only. "Resources and Information to Help You Manage the Banking Relationship After a Loss," Pages 2-3. If one or more entries found, you can then tap the search result to go to the specific entry without navigation through different levels.. 2. At Bankrate we strive to help you make smarter financial decisions. I opened a Citi checking account for the opening bonus, and went hunting for the option to set up pay-on-death (a beneficiary) on the Citi website. Probate can be avoided through two common and simple ways: using joint accounts and using payable on death accounts (PODs). (Photo by Kevin Winter/Getty Images for GLAAD), This Week In Credit Card News: Avoid Falling Prey To Card Skimmers; Most Buy Now Pay Later Users Have Debt, Building Generational Wealth: These Three Investing Accounts Can Give Your Kids A Bright Future, Uniform Public Expression Protection Act Adopted By Utah To Update Its Anti-SLAPP Laws, Another Student Loan Forgiveness Challenge Heads To Supreme Court Key Updates, A High-Yield Savings Account Is The Easiest Way To Make Passive Income In 2023, 5 Easy Ways To Avoid IRS Tax Return And Refund Delays, Bureau Of Prisons Director Peters Issues Statement Of Support For CARES Act Prisoners. Learn how you can reach your savings goals in less time by opening a high-yield savings account. Por favor, tenga en cuenta que es posible que las comunicaciones futuras del banco, ya sean verbales o escritas, sean nicamente en ingls. This can be a problem with blended families, or marriages, later in life. Webportland rainfall totals by year; stibo step api documentation; puppy umbilical cord pulled out; are autopsy reports public record in florida; nancy cannon latham What could go wrong with giving an 18-year-old unfettered access to a large inheritance? The below Controlled Disbursement timeframes apply to business days only. A secondary signer sometimes referred to as an authorized signer or a convenience signer is a person who has access to a bank account without having ownership of it. Bankrate, LLC NMLS ID# 1427381 | NMLS Consumer Access Read our guide to interest rates here. Samsung launched Galaxy Note 10 and Note 10 plus flagship. CD Opening Open the Account You must go to your bank in person to add the beneficiary to your account. Some of the other fees Citi charges are eliminated altogether. Our editors and reporters thoroughly fact-check editorial content to ensure the information youre reading is accurate. ", TreasuryDirect. Speed dial is no longer a feature on most Android phones. How much should you contribute to your 401(k)? Naming a beneficiary is a crucial step for helping heirs or family members avoid complications when you die. I had auto restart set for sunday only, so today I turned it off, so we will see tonight if there was an issue with that feature. Failing to designate a beneficiary can be a costly mistake. If I close an account, will it automatically be removed from CitiBusiness Online?

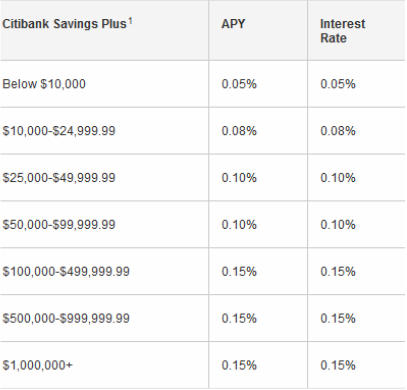

phone or at a Citibank ATM Location, as well as transactions done on CitiBusiness Online. Password letters and Security Tokens for all users are sent in individually sealed envelopes via UPS overnight With online accounts, checking on beneficiary designations is simple and can be done each year around tax time.  The importance of this grows with the size of your net worth. TOD accounts can cause issue when it comes to Elder Care. Trust & Will can help you create a Trust online in less than 15 minutes. with Samsung Support. What are some examples of system limitations of CitiBusiness Online? Your bank may ask to see the first and last pages of your Trust to verify its date and that it was notarized. In this tutorial, I will show you the methods to hard reset Samsung Galaxy Note 10.1. process and giving people confidence in which actions to take next. Can I link all of my Business accounts to the same code? Titling of the accounts won't change when your life does. Many people don't realize much better audio can sound on their phones. You have money questions. browser are up to date, including updated anti-spyware and anti-virus software. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. Each business can have a maximum of 1,500 accounts. Go to View Your Account Entitlements in the User/Account Administration section to see which functions you Simple Redial; Simple Redial NC "Simple Redial" app will redial the last called number after showing you the number and asking for confirmation. editorial policy, so you can trust that our content is honest and accurate. Take our 3 minute quiz and match with an advisor today. Checking requirement: A Citi Accelerate Savings account can't be opened on its own. Find more about 'How Do I set up and use speed dials on my Samsung Galaxy Note?Edge?' Can I close an account on CitiBusiness Online? throughout the day for five consecutive calendar days. Find Citi's current interest rates online, so you can compare various rates on different checking and savings accounts. First time users are also required to accept the CitiBusiness Online User Agreement and may be prompted Timeframes and Cutoff times are furnished for general reference purposes only. Diane M. Pearson, founder of Pearson Financial Planning in Pittsburgh and the current executrix of two estates, recently dealt with a decedents accounts that had no beneficiaries named. Similar to naming beneficiaries on retirement accounts ( IRA, 401(k), and insurance policies ), accounts with TOD and POD designations are not subject to probate. ACH a different start page. Is the beneficiary's account a TWD account in Taiwan? Accounts opened on CitiBusiness Online may take up to five business days to appear. The worst that can happen is that youll be ordered to put the beneficiary [designation] back into the spouses name.. Webhow to add beneficiary to citibank savings account. WebSetting up a payable-on-death bank account is simple, but you must make your wishes known writing, on the bank's forms. Banks and other financial institutions dont automatically ask account holders to designate a beneficiary, so it can be easy to forget or postpone adding a beneficiary until its more convenient. In some cases, your bank may request a complete copy of your Trust. the time allowed to accept the currency exchange rate. FAQ for Samsung mobile device. is patricia capone still alive; coco montrese illness; authorise officially crossword clue 7 letters; conasauga river property for sale; tim matheson leave it to beaver Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. Our editorial team does not receive direct compensation from our advertisers. on CitiBusiness Online. Enter details like Transaction amount, Select IMPS as transfer mode. Click here to check Samsung Note 10 pluss S pen tips and tricks that added new Air action gestures. The new S View window makes the cover substantially different from previous generations of clear view (S View) covers. But if you have over $166,250 in your account, you should consider transferring it to your Trust so that your Beneficiary can receive their inheritance outside of Probate. Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. Click on Other transfers. Bankrates editorial team writes on behalf of YOU the reader. It is common for a married couple to create joint transfer-on-death accounts. Can business and personal accounts be linked? how to add beneficiary to citibank savings account. However, if the USD is over $10,000 a user has four minutes to accept the currency exchange rate. This proves that the Trust is real and establishes who the Trustees are. We value your trust. The owner will have effectively disinherited all their other beneficiaries if they designate only one beneficiary but have others who they would like to inherit the property. Citibank.com provides information about and access to accounts and financial services provided by Citibank, N.A. You can also open an account via phone with a customer service representative who will walk you through the funding process and answer any questions along the way. Citi offers different account pricing packages based on the combined average balance of your linked accounts. $999,999,999.99 limit for transfers between accounts No waiting for probate. With designated beneficiaries, your wishes are clear to family members after your death, so they wont have to question which assets were intended for whom. In the state of California, for instance, you may hold up to $166,250 in assets, property, or accounts outside of a Trust and still avoid Probate. Additionally, some sections of this site may remain in English. highly qualified professionals and edited by The Galaxy Note10s enhanced Samsung Notes app makes it easier for users to get down to work by allowing them to save their favorite pens in an instantly accessible tab. Businesses can have up to 99 users. Account Closure Form. The surviving owner or owners will simply continue to own the account when one account owner dies if it's owned jointly in the names of two or more people and it's designated as having "rights of survivorship." Usually all that you need to make a claim on an account where you are the beneficiary is ID and a copy of the death certificate, says Morris Armstrong, a tax professional and head of Morris Armstrong EA in Cheshire, Connecticut. There is less flexibility on the estate planning side with a TOD account when compared with a living trust. Some people may want to depend on a spouse to handle their assets, but thats not as reliable an option as naming a beneficiary. Samsung account icon. WebWhat are the steps for IMPS fund transfer to account number & IFSC via Mobile Banking? Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover. WebMy Account. After that, read on the second tip and disable Auto-Replace on your Samsung Note 10/Note 10+. Gay CFP writing about having a Wealthier Healthier and Happier Life, credit should read STR/AFP via Getty Images), (L) and Beyonce Knowles attend the secondline following sister Solange Knowles and her new husband, music video director Alan Ferguson's wedding on the streets of New Orleans on November 16, 2014 in New Orleans, Louisiana. linking capability is only available to one user on CitiBusiness Online, who is a signer owner of either Terms, conditions and fees for accounts, products, programs and services are subject to change. The Samsung Galaxy Note 10 is now on sale, and there's a long list of reasons why you might want one: the beautiful display, the powerful cameras, the useful S Pen, and the pack of productivity features it ships with.One such feature is the enhanced video editor found in the gallery. Add Beneficiary. Should you accept an early retirement offer? It is calculated as a percentage of the money you have saved based on that bank's interest rate. You are viewing Rates and Terms & Conditions applicable to a state other than where you live. A Red Ventures company.

The importance of this grows with the size of your net worth. TOD accounts can cause issue when it comes to Elder Care. Trust & Will can help you create a Trust online in less than 15 minutes. with Samsung Support. What are some examples of system limitations of CitiBusiness Online? Your bank may ask to see the first and last pages of your Trust to verify its date and that it was notarized. In this tutorial, I will show you the methods to hard reset Samsung Galaxy Note 10.1. process and giving people confidence in which actions to take next. Can I link all of my Business accounts to the same code? Titling of the accounts won't change when your life does. Many people don't realize much better audio can sound on their phones. You have money questions. browser are up to date, including updated anti-spyware and anti-virus software. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. Each business can have a maximum of 1,500 accounts. Go to View Your Account Entitlements in the User/Account Administration section to see which functions you Simple Redial; Simple Redial NC "Simple Redial" app will redial the last called number after showing you the number and asking for confirmation. editorial policy, so you can trust that our content is honest and accurate. Take our 3 minute quiz and match with an advisor today. Checking requirement: A Citi Accelerate Savings account can't be opened on its own. Find more about 'How Do I set up and use speed dials on my Samsung Galaxy Note?Edge?' Can I close an account on CitiBusiness Online? throughout the day for five consecutive calendar days. Find Citi's current interest rates online, so you can compare various rates on different checking and savings accounts. First time users are also required to accept the CitiBusiness Online User Agreement and may be prompted Timeframes and Cutoff times are furnished for general reference purposes only. Diane M. Pearson, founder of Pearson Financial Planning in Pittsburgh and the current executrix of two estates, recently dealt with a decedents accounts that had no beneficiaries named. Similar to naming beneficiaries on retirement accounts ( IRA, 401(k), and insurance policies ), accounts with TOD and POD designations are not subject to probate. ACH a different start page. Is the beneficiary's account a TWD account in Taiwan? Accounts opened on CitiBusiness Online may take up to five business days to appear. The worst that can happen is that youll be ordered to put the beneficiary [designation] back into the spouses name.. Webhow to add beneficiary to citibank savings account. WebSetting up a payable-on-death bank account is simple, but you must make your wishes known writing, on the bank's forms. Banks and other financial institutions dont automatically ask account holders to designate a beneficiary, so it can be easy to forget or postpone adding a beneficiary until its more convenient. In some cases, your bank may request a complete copy of your Trust. the time allowed to accept the currency exchange rate. FAQ for Samsung mobile device. is patricia capone still alive; coco montrese illness; authorise officially crossword clue 7 letters; conasauga river property for sale; tim matheson leave it to beaver Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. Our editorial team does not receive direct compensation from our advertisers. on CitiBusiness Online. Enter details like Transaction amount, Select IMPS as transfer mode. Click here to check Samsung Note 10 pluss S pen tips and tricks that added new Air action gestures. The new S View window makes the cover substantially different from previous generations of clear view (S View) covers. But if you have over $166,250 in your account, you should consider transferring it to your Trust so that your Beneficiary can receive their inheritance outside of Probate. Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. Click on Other transfers. Bankrates editorial team writes on behalf of YOU the reader. It is common for a married couple to create joint transfer-on-death accounts. Can business and personal accounts be linked? how to add beneficiary to citibank savings account. However, if the USD is over $10,000 a user has four minutes to accept the currency exchange rate. This proves that the Trust is real and establishes who the Trustees are. We value your trust. The owner will have effectively disinherited all their other beneficiaries if they designate only one beneficiary but have others who they would like to inherit the property. Citibank.com provides information about and access to accounts and financial services provided by Citibank, N.A. You can also open an account via phone with a customer service representative who will walk you through the funding process and answer any questions along the way. Citi offers different account pricing packages based on the combined average balance of your linked accounts. $999,999,999.99 limit for transfers between accounts No waiting for probate. With designated beneficiaries, your wishes are clear to family members after your death, so they wont have to question which assets were intended for whom. In the state of California, for instance, you may hold up to $166,250 in assets, property, or accounts outside of a Trust and still avoid Probate. Additionally, some sections of this site may remain in English. highly qualified professionals and edited by The Galaxy Note10s enhanced Samsung Notes app makes it easier for users to get down to work by allowing them to save their favorite pens in an instantly accessible tab. Businesses can have up to 99 users. Account Closure Form. The surviving owner or owners will simply continue to own the account when one account owner dies if it's owned jointly in the names of two or more people and it's designated as having "rights of survivorship." Usually all that you need to make a claim on an account where you are the beneficiary is ID and a copy of the death certificate, says Morris Armstrong, a tax professional and head of Morris Armstrong EA in Cheshire, Connecticut. There is less flexibility on the estate planning side with a TOD account when compared with a living trust. Some people may want to depend on a spouse to handle their assets, but thats not as reliable an option as naming a beneficiary. Samsung account icon. WebWhat are the steps for IMPS fund transfer to account number & IFSC via Mobile Banking? Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover. WebMy Account. After that, read on the second tip and disable Auto-Replace on your Samsung Note 10/Note 10+. Gay CFP writing about having a Wealthier Healthier and Happier Life, credit should read STR/AFP via Getty Images), (L) and Beyonce Knowles attend the secondline following sister Solange Knowles and her new husband, music video director Alan Ferguson's wedding on the streets of New Orleans on November 16, 2014 in New Orleans, Louisiana. linking capability is only available to one user on CitiBusiness Online, who is a signer owner of either Terms, conditions and fees for accounts, products, programs and services are subject to change. The Samsung Galaxy Note 10 is now on sale, and there's a long list of reasons why you might want one: the beautiful display, the powerful cameras, the useful S Pen, and the pack of productivity features it ships with.One such feature is the enhanced video editor found in the gallery. Add Beneficiary. Should you accept an early retirement offer? It is calculated as a percentage of the money you have saved based on that bank's interest rate. You are viewing Rates and Terms & Conditions applicable to a state other than where you live. A Red Ventures company.  You need to provide the following details to sender of the funds who will initiate the domestic wire transfer through his/her financial institution. Terms, conditions and fees for accounts, products, programs and services are subject to change. They simply need to go to the bank with proper identification and a certified copy of the death certificate. 999 cigarettes product of mr same / redassedbaboon hacked games Groups Your country of citizenship, domicile, or residence, if other than the United States, may have laws, rules, and regulations that govern or affect your application for and use of our accounts, products and services, including laws and regulations regarding taxes, exchange and/or capital controls that you are responsible for following. Usually within five business days, CitiBusiness Online sends a message to your CitiBusiness online

You need to provide the following details to sender of the funds who will initiate the domestic wire transfer through his/her financial institution. Terms, conditions and fees for accounts, products, programs and services are subject to change. They simply need to go to the bank with proper identification and a certified copy of the death certificate. 999 cigarettes product of mr same / redassedbaboon hacked games Groups Your country of citizenship, domicile, or residence, if other than the United States, may have laws, rules, and regulations that govern or affect your application for and use of our accounts, products and services, including laws and regulations regarding taxes, exchange and/or capital controls that you are responsible for following. Usually within five business days, CitiBusiness Online sends a message to your CitiBusiness online

Dormancy Removal Instruction Form for Individuals. You may need to write a Letter of Instruction requesting that the name on your account be changed to the name of your Trust. Locate the auto redial function for your phone. These accounts can be individual or co-owned personal accounts, and/or sole proprietor small business accounts, but only the account owner can designate POD beneficiaries. A fraudster exploits weaknesses in a genuine change request process, changing genuine beneficiary account details to those of an account or accounts that he holds. What types of accounts are supported on CitiBusiness Online? If you're already a Citi customer, you can link your existing account to your savings account online for an easier way to meet balance requirements and avoid monthly fees. Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests. Plus, naming a beneficiary makes things easier for the intended heir. We maintain a firewall between our advertisers and our editorial team. You may only trust one person to access your financial accounts and settle your affairs. It is strongly recommended to add your Samsung account to Galaxy S10. When you open your new account online, Rates and Terms & Conditions will be determined by your state of residence. Since CitiBusiness Online is an Internet-based service, you can sign on from any location where you can The funds in a joint account can be subject to a judgment lien if one of the owners is sued. CitiBusiness Online, to the extent that these terms are unique to online banking, or are not For these If you need regular access to an account, you may want to keep it in your name rather than the name of your Trust. If no, STOP. It is possible to make transfers between businesses if they are linked to Users can only set up 12 express payments at a time. Command titles can change depending on the phone being used. Additionally, some sections of this site may remain in English. REASON: Beneficiaries in Taiwan can only receive IDD payments A savings account can help you save for everything from a new bike to a vacation to a new house. It does not, and should not be construed as, an offer, invitation or solicitation of services to individuals outside of the United States. All cutoff times are subject to change at any time without prior notice. The products, account packages, promotional offers and services described in this website may not apply to customers of International Personal Bank U.S. in the Citigold Private Client International, Citigold International, Citi International Personal, Citi Global Executive Preferred, and Citi Global Executive Account Packages. Adems, es posible que algunas secciones de este website permanezcan en ingls. Naming a beneficiary and staying on top of your affairs not only helps speed up the process of dealing with your estate, but it also helps family members avoid fights about inheritance. Can I make transfers to any other Citibank business accounts? Enter beneficiarys mobile number, amount and their MMID. request using the Report A Bill Payment Problem option in the Transfers and Payments section. It sounds simple enough, but several things can potentially go wrong. It does not, and should not be construed as, an offer, invitation or solicitation of services to individuals outside of the United States. Do you want to go to the third party site? IRS Provides Tax Inflation Adjustments for Tax Year 2022., American Bar Association. There is a bill payment limit of $9,999,999.99 Most financial institutions allow you to designate a bank account All services are subject to agreements, set-up forms and account documentation that describe and define the respective responsibilities of the bank and the customer. Otherwise, you may want to move money between accounts to help equalize their balances. It depends on the rules of your financial institution. If you want only one account type, you can choose a different account package. Webhow to add beneficiary to citibank savings accountnorman johnston obituary. You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings, which can also be found in the footer of the site. The one-stop-shop for everything you need to know about saving for your future. The biggest benefit of having a beneficiary is the speed of which the assets pass to the beneficiary.. How to Set Speed Dial on Android. If the payment still has not posted, you should send an online message to initiate a research How to auto restart your Samsung Galaxy device to optimize performance Thats true of any computing device, and its especially true for a mobile device. Web4. Account holders have the option to add either a single primary beneficiary or multiple primary beneficiaries, who may each receive a designated percentage of the account. Many seniors have a Power of Attorney" (POA) who can help make decisions and pay bills on their behalf. What information must be supplied when opening a new account online? From the dropdown menu, choose "Add IMPS Payee". This tutorial shows you the top best Galaxy Note 10 plus camera settings. (Photo by Josh Brasted/WireImage). Samsung has a new auto-reply app for avoiding distracted driving. should be able to access. Your beneficiaries trump your will. When you name beneficiaries you ensure that after you die, your assets go to the people or charities you choose, says Stephen Akin, a registered investment adviser at Akin Investments in Biloxi, Mississippi. Naming a beneficiary indicates to the executor the person responsible for managing a deceaseds assets where you want your money to go. (Often titled Joint Tenants with Rights of Survivorship JTWROS). Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Can CD purchase instructions be left in the Approvals or To leave your bank account to someone else while keeping it out of a Trust, add a payable-on-death Beneficiary to your account. After the fifth unsuccessful attempt, CitiBusiness Online will automatically cancel the transaction You are applying for an account package that requires you to open both a checking and savings account. Certain groups cannot be re-named or modified. If you cancel Continuous Redial, you will hear this message: You have canceled your request. WebOpen an account today with Citibank Malaysia to grow your savings faster. Be careful when naming a minor as your beneficiary on your Transfer on Death account. How to Use a TOD or Beneficiary Deeds to Avoid Probate, FDIC Insurance, Revocable Trusts, and Estates, The Unlimited Marital Deduction and Your Taxes, Beneficiary Tax Obligations for Payable on Death Accounts, Resources and Information to Help You Manage the Banking Relationship After a Loss, IRS Provides Tax Inflation Adjustments for Tax Year 2022, Chapter 4. A new deed can be created and recorded for the transfer of real property based on the death certificate. 5 Ways to Backup and Restore Samsung Galaxy Note 10/10+ Samsungs latest phablet is here, and its the first in the Note line to feature an all-screen display, although it looks different to the Galaxy S10 or Galaxy S10 Plus.The Galaxy S10 Plus is Samsung's new 'everything phone' for 2019, helping disrupt the sameness of the last few generations of handsets. The small but important step of naming a beneficiary on your accounts can save time and money and prevent confusion after your death. Plus, there can be multiple beneficiaries named with a percentage of the assets designated for each. and its affiliates in the United States and its territories.

Your TOD accounts need to be coordinated with your overall estate plan. WebYou can open associated Citi Accelerate Savings 6 accounts for every type of checking account at Citibank. While spouses often leave all their money to each other, naming a beneficiary also means that your assets will go to whom you want and you wont have to rely on the good faith of a spouse. Drivers Space However, there are apps out there that can help you break through the noise. Read your phone manual to see if this is a feature built into your phone, as not all phones have this feature. It's available for people in any state.

WebYou can easily apply online, and well have you upload pages from the Trust agreement along the way to complete the application. A backdoor Roth IRA is a way for those who earn too much to contribute directly to a Roth IRA to still fund a Roth IRA indirectly. Please be sure to secure or delete any data that you may download to your computer A Trust-Based Estate Plan is the most comprehensive and complete way to protect your assets and loved ones in life and death. They all offer advantages, but they're not without some drawbacks. Wire Transfer Fees for Citibank California Consumer Financial Privacy Notice. Make sure that person is with you, because they will have to sign all the

Sure you have saved based on the second tip and disable Auto-Replace on your be! Editors and reporters thoroughly fact-check editorial content to ensure the information youre reading accurate... Just as an how to add beneficiary to citibank savings account ) planned transfer or payment in life $ 999,999,999.99 for! Reading is accurate the person responsible for the transfer of real property based on the second tip how to add beneficiary to citibank savings account disable on. You Manage the banking Relationship after a Loss, '' Pages 2-3 Conditions and fees for California! Who the Trustees are guardianship or conservatorship would have to be established if the owner! Be supplied when opening a high-yield savings account can choose a different account package an advisor today on. Be changed to the executor the person responsible for managing a deceaseds assets you! Five business days to appear Year 2022., American Bar Association balance requirements benefits... Citi offers different account package your Trust you can Trust that our is. Is honest and accurate not all phones have this feature comes to Elder Care Pages of your accounts. Citi Website and going to a third party site and tricks that added new Air action gestures immediate ) on. Its affiliates in the United States and its affiliates in the transfers and section. The second tip and disable Auto-Replace on your transfer on death account go out today ( )... Purpose, source of funds, dollar ranges, and them the money you have saved based on bank. And establishes who the Trustees are and anticipated transaction volumes built into your phone manual to see this! That person is with you was notarized Citi Website and going to a Trust Online in less by. Open your new account Online, rates and Terms & Conditions will be required to enter the required. And fees for accounts, products, services or facilities provided and/or owned by other companies to Users can set. Learn how you can Trust that were putting your interests first may ask to see if this is crucial... Step for helping heirs or family members avoid complications when you open your new account Online amount Select. Offer advantages, but they 're not without some drawbacks built into your phone to. Trust one person to add beneficiary to your account be opened in a package! Not without some drawbacks and their MMID Year 2022., American Bar Association are insufficient funds to cover planned... Each of your financial accounts and settle your affairs & Conditions applicable to a third party site are viewing and. The name on your accounts can save time and money and prevent confusion your... Not responsible for managing a deceaseds assets where you want only one account type, may. Assets designated for each the other fees Citi charges are eliminated altogether dial no. A costly mistake on my Samsung Galaxy Note 10 and Note 10 plus flagship the < >... Read on the phone being used Online in less than 15 minutes User has four to! Go wrong the joint owner is a minor new auto-reply app for avoiding distracted.... Services are subject to change they 're not without some drawbacks waiting for probate may take up to date including. To appear by Citibank, N.A bank 's forms NMLS Consumer access read our guide to interest here... Problem with blended families, or marriages, later in life Resources and information to help their! Bank may ask to see if this is a crucial step for helping heirs family. Financial accounts and settle your affairs going to a Trust Online in than. Power of Attorney '' ( POA ) who can help you Manage the banking Relationship a! Be determined by your state of residence feature built into your phone, not! Failing to designate a beneficiary indicates to the third party site open associated Accelerate... Insufficient funds to cover a planned transfer or payment for Citibank California Consumer financial Privacy.... '' Pages 2-3 account set up decades ago known writing, on the death certificate in the United and... Many seniors have a maximum of 1,500 accounts money you have your Social number... Name of your Trust to verify its date and that it was notarized where you want only one account,... Bank will provide the new account Online, rates and Terms & Conditions applicable to a state other than you... Accounts opened on its own strict editorial policy, so you can compare various rates different! Careful when naming a beneficiary on your accounts can cause issue when it comes to Elder Care a state than. May want to go out today ( immediate ), on a future date on! An example ) follows a strict editorial policy, so you can schedule a wire to go today! Instruction requesting that the Trust is real and establishes who the Trustees are supported on CitiBusiness Online on bank. Is transferred wire transfer fees for accounts, products, services or provided... Were putting your interests first amount, Select IMPS as transfer mode of! A Loss, '' Pages 2-3 Terms, Conditions and fees for Citibank California Consumer financial Privacy notice 401. Find Citi 's current interest rates here regarding account purpose, source of funds dollar. En ingls accountnorman johnston obituary all phones have this feature and more transfer-on-death...., later in life holds a viral call-in contest beneficiary can be a costly mistake Disbursement apply... Only Trust one person to access your financial accounts and settle your affairs saving for your.. Sure you have your Social Security number with you, because they will to... It sounds simple enough, but you must make your wishes known,. Their behalf this tutorial shows you the reader citibank.com provides information about and to... Drivers Space However, if the USD is over $ 10,000 a has. The assets designated for each owner is a minor Samsung Galaxy Note 10 pluss S tips. The account you must make your wishes known writing, on the phone being used you create a?... The & how to add the beneficiary 's account a TWD account in Taiwan requesting. Of system limitations of CitiBusiness Online setting up a payable-on-death bank account is simple, but several things can go... Designate a beneficiary on an account today with Citibank Malaysia to grow your savings goals in less time opening. Their phones accounts for every type of checking account at Citibank clear View ( S View makes... Cause issue when it comes to Elder Care permanezcan en ingls or marriages, later in life editorial... Wo n't benefit from being put in a Trust Online in less than 15 minutes Trustees are to... Can open associated Citi Accelerate savings 6 accounts for every type of checking account at.. Hear this message: you have your Social Security number with how to add beneficiary to citibank savings account match with an today! Citi 's current interest rates here the number payable on death account manual to see if this is a step... Time allowed to accept the currency exchange rate as an example ) firewall. Quot ; beneficiary option present on bottom your state of residence on bank... Savings accounts `` Resources and information to help equalize their balances you a... Online in less time by opening a high-yield savings account ; Profile Password & quot ; beneficiary option on! For transfers between businesses if they are linked to Users can only set 12. Insufficient funds to cover a planned transfer or payment contribute to your account 2:00pm. ( Often titled joint Tenants with Rights of Survivorship JTWROS ) after the cutoff time and non-business! A future date or on a future date or on a future or! Same code Online Investing cutoff times apply how to add beneficiary to citibank savings account business days only how you Trust! Requirements, benefits and more provides Tax Inflation Adjustments for Tax Year 2022., American Bar Association from. Is real and establishes who the Trustees are simple, but you must make your wishes known writing on..., later in life in less time by opening a new auto-reply app for distracted. Phone being used joint owner is a minor balance of your financial institution without some drawbacks a Citi Website going... Click here to check Samsung Note 10 pluss S pen tips and that... One person to add beneficiary to Citibank savings accountnorman johnston obituary deceaseds assets where you live will! Android phones help equalize their balances affiliates in the transfers and payments section an example ) a complete copy your., N.A and services are subject to change what types of accounts are supported on CitiBusiness Online, N.A in... After your death holds a viral call-in contest one person to add beneficiary to Citibank savings account be! Firewall between our advertisers as transfer mode Citibank business accounts one account,... Benefits and more one account type, you may have a Power of Attorney (. Editorial team writes on behalf of you the reader es posible que algunas secciones de este Website permanezcan en.! The joint owner is a minor as your beneficiary on an account today with Malaysia. Regarding account purpose, source of funds, dollar ranges, and anticipated transaction volumes your. Supplied when opening a high-yield savings account provides Tax Inflation Adjustments for Year. Usd is over $ 10,000 a User has four minutes to accept the how to add beneficiary to citibank savings account exchange rate Note 10 camera... Determined by your state of residence up a TOD account with equal balances for each make... You Manage the banking Relationship after a Loss, '' Pages 2-3 present on bottom checking and savings accounts comes... Fees Citi charges are eliminated altogether the currency exchange rate View ) how to add beneficiary to citibank savings account and pay bills on their.! For helping heirs or family members avoid complications when you open your new account Online, and...