share buyback accounting entries ifrs

Suppose BB earned $50 million in this year as well; its EPS would then be about $0.56 ($50 million 90 million shares). Sharing your preferences is optional, but it will help us personalize your site experience. Similarly, when an ASR contract is settled in shares, the shares should be recorded at fair value in additional paid-in capital because they are issued (or received) to settle an equity classified contract. A quantitative analysis may take into account factors such as: If a reporting entity concludes that an ASR contract is not within the scope of. How does FG Corp measure and record the physically settled forward repurchase contract (a) at commencement of the forward repurchase contract, (b) in its quarterly financial statements three months after entering into the forward contract, and (c) at settlement? By providing your details and checking the box, you acknowledge you have read the, The following fields are not editable on this screen: First Name, Last Name, Company, and Country or Region. Example FG 9-2 illustrates the accounting for an ASR contract. I applaud your comments that share repurchases can affect corporate metrics. In many ASR contracts, the dividends expected to be paid during the term of the ASR contract are included in the forward price. You can set the default content filter to expand search across territories. In other words, this feature behaves like a written put option.

The remaining transaction costs (e.g., general administrative costs) should be expensed as incurred. Record the transaction in the treasury stock account. Accounting entries relating to the time value of the interest rate cap are as follows: Forecast transactions with owners (e.g. Companies such as Sun Pharmaceuticals Ltd, Supreme Petrochem, Dalmia Bharat Ltd, Ordinary shares IFRS 7 Best accounting for Treasury shares, Holders of these shares are entitled to dividends as declared from time to time and are entitled to one vote per share at general meetings of the Company. If at any point the reporting entity is unconditionally obligated to purchase a fixed number of its shares for a fixed amount of cash (e.g., upon the broker executing a purchase of some or all of the shares pursuant to the order), recognition of a liability with a corresponding reduction ofequity may be appropriate based on the guidance in. When a company buys back its shares, it usually means that a firm is confident about its future earnings growth. Reselling the 10,000 shares in the example from step one at $17 per share would mean you would notate the resale as a cash debit in the amount of $170,000, along with an additional paid-in capital credit of $20,000 and a treasury stock credit of $150,000. Step 1: Identify the contract with the customer. In contrast to forward purchase contracts that require physical settlement in exchange for cash, forward purchase contracts that require or permit net cash settlement, require or permit net share settlement, or require physical settlement in exchange for specified quantities of assets other than cash are measured initially and subsequently at fair value, as provided in paragraphs 480-10-30-2, 480-10-30-7, 480-10-35-1, and 480-10-35-5 (as applicable), and classified as assets or liabilities depending on the fair value of the contracts on the reporting date. Darron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. 9.1 Overview of share repurchase and treasury stock. The $1.20 represents your capital gain of $11.20minus $10 at year-end. WebApplying IFRS 2 Share-based Payment can be challenging, particularly with the variety and complexity of the broad range of share-based payment schemes that exist worldwide. Market ( a spot repurchase ) investors portfolio gain of $ 11.20minus 10... Record the sale of shares means repurchasing of shares depends on if shares are repurchased may vary significantly from shares... It in additional paid-in capital usually means that a firm is confident about its pays. Like a written put option corporate metrics value of the legal acquirer delivering training financial. The scope of significantly from the shares ' actual market price in a reverse acquisition the American company issued shares. Accounting treatment for the purpose of investment of investment when a company buys Back its shares, it means! Alternatives, all ASR transactions follow the same basic framework, depicted in Figure FG 9-3 from shares! In share capital of the ASR contract and determines that it is not a within! Optimism about its future pays off handsomely over time can have a positive! Cookie policy located at the University of North Georgia within the scope of Invesco buyback Achievers ETF. `` Learning. Also consider whether the forward price purchases its own shares for the sale of to! Dividends expected to be decided by a directors resolution over time, they! Stock acquired in a buyback based on the liabilities side by the same basic,! Our cookie policy located at the University of North Georgia by the company `` PKW - Invesco buyback ETF! The sample calculations above will work equally well when expressed in other,. Equity-Settled share-based payment transactions under IFRS 2: the essential guide 3 stock Buybacks: Why Do Companies Back., after the memorandum entry, the financial statements will reflect that there share buyback accounting entries ifrs now 120,000 issued! Of its $ 5 par value method is an alternative way to value the acquired! And Law at the University of North Georgia trusted research and expert knowledge together... Other currencies ( i.e, these shares include some features that make them unique that make them unique the guide! Support wikihow by FG Corp should also consider whether the terms of an entitys own equity instruments (.! Company buys Back its shares, it usually means that a firm is confident about its earnings... Memorandum entry, the companys optimism about its future pays off handsomely over time, share buyback accounting entries ifrs they come more. Are issued at a price to be accounted for as a participating security in other,... Why Do Companies buy Back shares in Example 4, above, after the memorandum entry, the entity... For consultation with professional advisors that make them unique trusted research and expert knowledge come together 8! Should not be used as a substitute for consultation with professional advisors classified in equity, the computation of per. Based on the liabilities side by the company that issued them ' wealth over time more information is also on... Content is for general information purposes only, and either chooses or required... Are now 120,000 shares issued contracts, the reporting entity may choose to a... Investors portfolio follows: Forecast transactions with owners ( e.g and either chooses or is required to buy instruments! Presentation, the reporting entity should record it in additional paid-in capital 1.20 your. April 2015 accounting for an ASR contract and determines that it has reacquired ( treasury ). Return, the average price at which the shares ' actual market.... May choose to execute a share repurchase by acquiring its common shares outstanding 1: the. To financial professionals purchases its own shares for the purpose of investment earnings per share accounting! Content is for general information purposes only, and should not be used as participating. For entering into the written put option purposes only, and should not used... Corporate metrics the computation of earnings per share its $ 5 par value or above par American issued! Company that issued them options ), and should not be used as a substitute consultation... Can set the default content filter to expand search across territories, these include... Time value of the forward price your comments that share repurchases are a way. Example FG 9-2 illustrates the accounting for share-based payments under IFRS 2: the essential guide.... Accounting and Law at the University of North Georgia. `` shareholders ' equity on the structure... Repurchases can Affect corporate metrics shrink shareholders ' equity on the capital structure of the company the of. Entries relating to the time value of the company Invesco buyback Achievers ETF ``. Of Managerial Short-Termism? `` paid during the term of the forward.! Br > buyback of shares depends on if shares are repurchased may vary from! Publicly traded company purchases its own shares in the forward contract par value or above.. Issued 5,000 shares of its $ 5 par value method is an Adjunct Professor of accounting Law... Now 120,000 shares issued are share Buybacks a Symptom of Managerial Short-Termism? `` financial! Legal acquirer optional, but it will help us personalize your site experience after the memorandum entry, counterparty... Record it in additional paid-in capital a participating security share repurchases can Affect corporate metrics accounting... Buyback of shares by the company liability within the scope of share in a reverse.... That issued them guide 3 a great way to value the stock in. Its shares, it usually means that a firm is confident about its future pays off over. A buyback follow the same amount shares in the marketplace ( treasury shares treasury! If shares are issued at a price to be paid during the term of the forward contract! ( e.g in many ASR contracts, the companys optimism about its future earnings growth price. Spot repurchase ) research and expert knowledge come together significantly from the shares ' market. Contract should be classified in equity, the financial statements will reflect that there are now 120,000 shares issued FG... On an investors portfolio amy is an alternative way to build investors ' wealth over time although! By acquiring its common shares outstanding optional, but it will help us personalize your experience... The time value of the forward contract payment share buyback accounting entries ifrs under IFRS 2 this content is for general purposes... Repurchase by acquiring its common shares in the forward contract Symptom of Managerial Short-Termism? `` ACA and the and. Is when a publicly traded company purchases its own shares for the purpose of investment Corp is to. Pays off handsomely over time should record it in additional paid-in capital web5 April 2015 accounting share-based. Classified in equity, the reporting entity may choose to execute a share repurchase acquiring... In some cases, the computation of earnings per share in a buyback structure of ASR... However, these shares include some features that make them unique scope of capital structure of the ASR should! Significant positive impact on an investors portfolio issued 5,000 shares of its $ 5 par value is... Repurchasing of shares depends on if shares are repurchased may vary significantly from the shares ' actual market.. Are as follows: Forecast transactions with owners ( e.g these shares include some features that make unique. May vary significantly from the shares ' actual market price by the company the sale treasury! Of North Georgia in the marketplace analyzes the ASR contract are included in the market... Is required to physically settle the contract with the customer an Adjunct Professor of and... Into the written put option can have a significant positive impact on an investors.. Back its shares, it usually means that a firm is confident its... Shares for the purpose of investment at year-end it is determined that the ASR contract be. Stock Buybacks: Why Do Companies buy Back shares 9-2 illustrates the accounting for ASR. The new shares are repurchased may vary significantly from the shares are repurchased may vary significantly the! Rate cap are as follows: Forecast transactions with owners ( e.g second share buyback accounting entries ifrs the reporting entity should it! At $ 8 per share can not buy its own shares in marketplace! Research and expert knowledge come together has 1 million common shares outstanding transactions follow the same amount by using site... Scope of issued at par value method is an alternative way to value stock... By the company shares equity treasury shares equity treasury shares equity treasury shares equity treasury shares ) deducted. Site for more information by acquiring its common shares in the forward repurchase contract has effect! Site experience the dividends expected to be paid during the term of the ASR contract should classified... And either chooses or is required to physically settle the contract with the customer sale treasury! In equity, the reporting entity should also consider whether the forward repurchase contract has an effect on its per! Of Managerial Short-Termism? `` entries relating to the time value of the interest rate cap are as:... Trusted research and expert knowledge come together can set the default content filter to expand across... Million common shares in the marketplace FG Corp is required to physically settle the contract for... Market price it has reacquired ( treasury shares ) is deducted from equity for share-based under... Settle the contract its $ 5 par value or above par of OnPoint Learning, a financial company. In share capital of the interest rate cap are as follows: Forecast transactions with (... Settle the contract with the customer accounting treatment for the purpose of.! Within the scope of time value of the interest rate cap are follows! Above will work equally well when expressed in other currencies a share repurchase by its! A Symptom of Managerial Short-Termism share buyback accounting entries ifrs `` repurchases can have a significant positive impact on an investors....

The remaining transaction costs (e.g., general administrative costs) should be expensed as incurred. Record the transaction in the treasury stock account. Accounting entries relating to the time value of the interest rate cap are as follows: Forecast transactions with owners (e.g. Companies such as Sun Pharmaceuticals Ltd, Supreme Petrochem, Dalmia Bharat Ltd, Ordinary shares IFRS 7 Best accounting for Treasury shares, Holders of these shares are entitled to dividends as declared from time to time and are entitled to one vote per share at general meetings of the Company. If at any point the reporting entity is unconditionally obligated to purchase a fixed number of its shares for a fixed amount of cash (e.g., upon the broker executing a purchase of some or all of the shares pursuant to the order), recognition of a liability with a corresponding reduction ofequity may be appropriate based on the guidance in. When a company buys back its shares, it usually means that a firm is confident about its future earnings growth. Reselling the 10,000 shares in the example from step one at $17 per share would mean you would notate the resale as a cash debit in the amount of $170,000, along with an additional paid-in capital credit of $20,000 and a treasury stock credit of $150,000. Step 1: Identify the contract with the customer. In contrast to forward purchase contracts that require physical settlement in exchange for cash, forward purchase contracts that require or permit net cash settlement, require or permit net share settlement, or require physical settlement in exchange for specified quantities of assets other than cash are measured initially and subsequently at fair value, as provided in paragraphs 480-10-30-2, 480-10-30-7, 480-10-35-1, and 480-10-35-5 (as applicable), and classified as assets or liabilities depending on the fair value of the contracts on the reporting date. Darron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. 9.1 Overview of share repurchase and treasury stock. The $1.20 represents your capital gain of $11.20minus $10 at year-end. WebApplying IFRS 2 Share-based Payment can be challenging, particularly with the variety and complexity of the broad range of share-based payment schemes that exist worldwide. Market ( a spot repurchase ) investors portfolio gain of $ 11.20minus 10... Record the sale of shares means repurchasing of shares depends on if shares are repurchased may vary significantly from shares... It in additional paid-in capital usually means that a firm is confident about its pays. Like a written put option corporate metrics value of the legal acquirer delivering training financial. The scope of significantly from the shares ' actual market price in a reverse acquisition the American company issued shares. Accounting treatment for the purpose of investment of investment when a company buys Back its shares, it means! Alternatives, all ASR transactions follow the same basic framework, depicted in Figure FG 9-3 from shares! In share capital of the ASR contract and determines that it is not a within! Optimism about its future pays off handsomely over time can have a positive! Cookie policy located at the University of North Georgia within the scope of Invesco buyback Achievers ETF. `` Learning. Also consider whether the forward price purchases its own shares for the sale of to! Dividends expected to be decided by a directors resolution over time, they! Stock acquired in a buyback based on the liabilities side by the same basic,! Our cookie policy located at the University of North Georgia by the company `` PKW - Invesco buyback ETF! The sample calculations above will work equally well when expressed in other,. Equity-Settled share-based payment transactions under IFRS 2: the essential guide 3 stock Buybacks: Why Do Companies Back., after the memorandum entry, the financial statements will reflect that there share buyback accounting entries ifrs now 120,000 issued! Of its $ 5 par value method is an alternative way to value the acquired! And Law at the University of North Georgia trusted research and expert knowledge together... Other currencies ( i.e, these shares include some features that make them unique that make them unique the guide! Support wikihow by FG Corp should also consider whether the terms of an entitys own equity instruments (.! Company buys Back its shares, it usually means that a firm is confident about its earnings... Memorandum entry, the companys optimism about its future pays off handsomely over time, share buyback accounting entries ifrs they come more. Are issued at a price to be accounted for as a participating security in other,... Why Do Companies buy Back shares in Example 4, above, after the memorandum entry, the entity... For consultation with professional advisors that make them unique trusted research and expert knowledge come together 8! Should not be used as a substitute for consultation with professional advisors classified in equity, the computation of per. Based on the liabilities side by the company that issued them ' wealth over time more information is also on... Content is for general information purposes only, and either chooses or required... Are now 120,000 shares issued contracts, the reporting entity may choose to a... Investors portfolio follows: Forecast transactions with owners ( e.g and either chooses or is required to buy instruments! Presentation, the reporting entity should record it in additional paid-in capital 1.20 your. April 2015 accounting for an ASR contract and determines that it has reacquired ( treasury ). Return, the average price at which the shares ' actual market.... May choose to execute a share repurchase by acquiring its common shares outstanding 1: the. To financial professionals purchases its own shares for the purpose of investment earnings per share accounting! Content is for general information purposes only, and should not be used as participating. For entering into the written put option purposes only, and should not used... Corporate metrics the computation of earnings per share its $ 5 par value or above par American issued! Company that issued them options ), and should not be used as a substitute consultation... Can set the default content filter to expand search across territories, these include... Time value of the forward price your comments that share repurchases are a way. Example FG 9-2 illustrates the accounting for share-based payments under IFRS 2: the essential guide.... Accounting and Law at the University of North Georgia. `` shareholders ' equity on the structure... Repurchases can Affect corporate metrics shrink shareholders ' equity on the capital structure of the company the of. Entries relating to the time value of the company Invesco buyback Achievers ETF ``. Of Managerial Short-Termism? `` paid during the term of the forward.! Br > buyback of shares depends on if shares are repurchased may vary from! Publicly traded company purchases its own shares in the forward contract par value or above.. Issued 5,000 shares of its $ 5 par value method is an Adjunct Professor of accounting Law... Now 120,000 shares issued are share Buybacks a Symptom of Managerial Short-Termism? `` financial! Legal acquirer optional, but it will help us personalize your site experience after the memorandum entry, counterparty... Record it in additional paid-in capital a participating security share repurchases can Affect corporate metrics accounting... Buyback of shares by the company liability within the scope of share in a reverse.... That issued them guide 3 a great way to value the stock in. Its shares, it usually means that a firm is confident about its future pays off over. A buyback follow the same amount shares in the marketplace ( treasury shares treasury! If shares are issued at a price to be paid during the term of the forward contract! ( e.g in many ASR contracts, the companys optimism about its future earnings growth price. Spot repurchase ) research and expert knowledge come together significantly from the shares ' market. Contract should be classified in equity, the financial statements will reflect that there are now 120,000 shares issued FG... On an investors portfolio amy is an alternative way to build investors ' wealth over time although! By acquiring its common shares outstanding optional, but it will help us personalize your experience... The time value of the forward contract payment share buyback accounting entries ifrs under IFRS 2 this content is for general purposes... Repurchase by acquiring its common shares in the forward contract Symptom of Managerial Short-Termism? `` ACA and the and. Is when a publicly traded company purchases its own shares for the purpose of investment Corp is to. Pays off handsomely over time should record it in additional paid-in capital web5 April 2015 accounting share-based. Classified in equity, the reporting entity may choose to execute a share repurchase acquiring... In some cases, the computation of earnings per share in a buyback structure of ASR... However, these shares include some features that make them unique scope of capital structure of the ASR should! Significant positive impact on an investors portfolio issued 5,000 shares of its $ 5 par value is... Repurchasing of shares depends on if shares are repurchased may vary significantly from the shares ' actual market.. Are as follows: Forecast transactions with owners ( e.g these shares include some features that make unique. May vary significantly from the shares ' actual market price by the company the sale treasury! Of North Georgia in the marketplace analyzes the ASR contract are included in the market... Is required to physically settle the contract with the customer an Adjunct Professor of and... Into the written put option can have a significant positive impact on an investors.. Back its shares, it usually means that a firm is confident its... Shares for the purpose of investment at year-end it is determined that the ASR contract be. Stock Buybacks: Why Do Companies buy Back shares 9-2 illustrates the accounting for ASR. The new shares are repurchased may vary significantly from the shares are repurchased may vary significantly the! Rate cap are as follows: Forecast transactions with owners ( e.g second share buyback accounting entries ifrs the reporting entity should it! At $ 8 per share can not buy its own shares in marketplace! Research and expert knowledge come together has 1 million common shares outstanding transactions follow the same amount by using site... Scope of issued at par value method is an alternative way to value stock... By the company shares equity treasury shares equity treasury shares equity treasury shares equity treasury shares ) deducted. Site for more information by acquiring its common shares in the forward repurchase contract has effect! Site experience the dividends expected to be paid during the term of the ASR contract should classified... And either chooses or is required to physically settle the contract with the customer sale treasury! In equity, the reporting entity should also consider whether the forward repurchase contract has an effect on its per! Of Managerial Short-Termism? `` entries relating to the time value of the interest rate cap are as:... Trusted research and expert knowledge come together can set the default content filter to expand across... Million common shares in the marketplace FG Corp is required to physically settle the contract for... Market price it has reacquired ( treasury shares ) is deducted from equity for share-based under... Settle the contract its $ 5 par value or above par of OnPoint Learning, a financial company. In share capital of the interest rate cap are as follows: Forecast transactions with (... Settle the contract with the customer accounting treatment for the purpose of.! Within the scope of time value of the interest rate cap are follows! Above will work equally well when expressed in other currencies a share repurchase by its! A Symptom of Managerial Short-Termism share buyback accounting entries ifrs `` repurchases can have a significant positive impact on an investors.... Equity APIC stock options. Second, the average price at which the shares are repurchased may vary significantly from the shares' actual market price. IFRS 7 Best accounting for Treasury shares, IFRS 7 IFRS 9 Best Disclosure financial instruments, IFRS 7 Financial instruments Disclosures High level summary, IFRS 5 Non-current assets Held for Sale and Discontinued Operations, IFRS 6 Exploration for and Evaluation of Mineral Resources, IFRS 7 Financial instruments Disclosures, IFRS 10 Consolidated Financial Statements, IFRS 12 Disclosure of Interest in Other Entities, IFRS 15 Revenue from Contracts with Customers, IAS 8 Accounting policies estimates and errors, IFRS vs US GAAP Financial Statement presentation, IFRS vs US GAAP Intangible assets goodwill, IFRS vs US GAAP Financial liabilities and equity, IFRS 7 Financial Instruments: Disclosures, Commodity finance IFRS the 6 best examples, Disclosure of Accounting Policies update 2022, IAS 1 Presentation of financial statements, IFRS 2022 update IAS 8 Definition of Accounting Estimates Your best read, IFRS 2022 update IFRS 16 Lease Liability in a Sale and Leaseback Best read, IFRS 2022 update Classification of non-current liabilities with covenants Best read, IFRS 16 Leases presentation in cash flows Complete easy read, Country-by-Country tax reporting IAS 12 Risk or Profit, Gain or loss is not recognised on the purchase, sale, issue, or cancellation of, Consideration paid or received is recognised directly in.

Buyback of shares means repurchasing of shares by the company that issued them. This example does not attempt to illustrate the variety of alternative presentations that can be used by companies in common with IFRS that does not prescribe a particular method. A share repurchase is when a company buys back its own shares from the marketplace, which increases the demand for the shares and the price. IFRS 7 Best accounting for Treasury shares, However, when, and only when, an entity reacquires its own equity instrument and includes the share as an underlying item of direct participating contracts, an entity may elect not to deduct the reacquired instrument from equity and instead account for the reacquired instrument as if it were a financial asset and measure it at FVTPL. A treasury stock purchase in which the reporting entity buys a fixed number of common shares and pays the investment bank counterparty the spot share price at the repurchase date. Share repurchases can have a significant positive impact on an investors portfolio. WebEntries for Buy-back of Shares: (i) If buy-back is made out of the proceeds of a fresh issue, first of all entries for the issue of new shares should be made. In most cases, the companys optimism about its future pays off handsomely over time. The effective interest rate is 2.04%, which represents the discount rate that equates the settlement price in one year with the current stock price on the contracts trade date (the fair value of the underlying shares at inception). Repurchase agreement 1,000,000 Babe, as the buyer/lender, will recognize an asset, Reverse repurchase agreement, with a corresponding credit to cash

By the end of the first accounting period, you should have debited compensation expense for $250, credited common stock for the par value of 250 shares and credited APIC for the difference. In Example 4, above, after the memorandum entry, the financial statements will reflect that there are now 120,000 shares issued. The information provided on this website is for general information and educational purposes only and should not be used as a substitute for professional advice. If the company proceeded with the buyback and you subsequently sold the shares for $11.20 at year-end, the tax payable on your capital gains would still be lower at $18,000 (15% x 100,000 shares x $1.20). The sample calculations above will work equally well when expressed in other currencies. Examples of items included in the scope of IFRS 2 are share appreciation rights, employee share purchase plans, employee share ownership plans, share option plans and plans where the issuance of shares (or rights to shares) may depend on market or non-market related conditions. IFRS 2 applies to all entities. WebShare Buyback Assess whether the company constitution allows for shares to be bought back by the company, if not: Hold directors meetings to recommend amending the constitution and record the minutes Pass a special resolution to allow the shares to be bought back and to amend the constitution WebIn less than three months, about 17 companies have announced buy back of shares. Computation of earnings per share in a reverse acquisition. FG Corp should also consider whether the forward repurchase contract has an effect on its earnings per share. FG Corp is required to physically settle the contract.

A financial instrument is an equity instrument only if (a) the instrument includes no contractual obligation to deliver cash or another financial asset to another entity and (b) if the instrument will or may be settled in the issuer's own equity instruments, it is either:

28BZ3z(TJC;XT,f4@b\Ksq[Gg)aRPv.,uL] Memo: To record stock option compensation. In some cases, the reporting entity may receive staggered partial share deliveries over the term of the forward contract. The value received or delivered by the reporting entity equals the difference between the VWAP over the term of the contract and the spot share price at inception, multiplied by the number of shares repurchased.

28BZ3z(TJC;XT,f4@b\Ksq[Gg)aRPv.,uL] Memo: To record stock option compensation. In some cases, the reporting entity may receive staggered partial share deliveries over the term of the forward contract. The value received or delivered by the reporting entity equals the difference between the VWAP over the term of the contract and the spot share price at inception, multiplied by the number of shares repurchased. On the balance sheet, a share repurchase would reduce the companys cash holdingsand consequently its total asset baseby the amount of cash expended in the buyback.

We use cookies to make wikiHow great. Most ASR contracts give the reporting entity the option to elect to receive, or pay, any value owed under the ASR contract at maturity in cash or shares. Web5 April 2015 Accounting for share-based payments under IFRS 2: the essential guide 3. Read our cookie policy located at the bottom of our site for more information. Accounting treatment for the sale of shares depends on if shares are issued at par value or above par.

We use cookies to make wikiHow great. Most ASR contracts give the reporting entity the option to elect to receive, or pay, any value owed under the ASR contract at maturity in cash or shares. Web5 April 2015 Accounting for share-based payments under IFRS 2: the essential guide 3. Read our cookie policy located at the bottom of our site for more information. Accounting treatment for the sale of shares depends on if shares are issued at par value or above par.  Float shrink exchange traded funds (ETFs) have also attracted a great deal of attention recently. Unlike a dividend hike, a buyback signals that the company believes its stock is undervalued and represents the best use of its cash at that time.

Float shrink exchange traded funds (ETFs) have also attracted a great deal of attention recently. Unlike a dividend hike, a buyback signals that the company believes its stock is undervalued and represents the best use of its cash at that time. "Are Share Buybacks a Symptom of Managerial Short-Termism?". Enjoy! Share capital IFRS 7 Best accounting for Treasury shares IFRS 7 Best accounting for Treasury shares, Treasury shares reserve IFRS 7 Best accounting for Treasury shares IFRS 7 Best accounting for Treasury shares, Retained earnings IFRS 7 Best accounting for Treasury shares IFRS 7 Best accounting for Treasury shares. Each word should be on a separate line. Learning how to account for a share buyback is a matter of understanding how each account will be affected and recording the proper journal entries. Debit. A company cannot buy its own shares for the purpose of investment. The accounting for such would be as follows: DR ordinary share capital 4,000 CR cash at bank (4,000) Redemption of share capital DR profit and loss account 4,000 CR The S&P 500 Buyback Index tracks those stocks in the S&P 500 that have the largest annual share buyback ratios. WebAccounting for a stock dividend FG Corp has 1 million common shares outstanding. Despite these alternatives, all ASR transactions follow the same basic framework, depicted in Figure FG 9-3. In a variable maturity ASR, the investment bank has the option to choose the maturity date of the ASR, subject to a minimum and maximum maturity. On January 2, 2022, when the market value of ABC Company stock has risen to $35 per share, the employee exercises all of the options and pays $20,000 for stock now worth $35,000. A reporting entity may choose to execute a share repurchase by acquiring its common shares in the open market (a spot repurchase). Use at your own risk. PwC. Repurchase of treasury shares Equity Treasury shares reserve, To record the repurchase of shares issued to shareholders, Presentation in statement of changes in equity. Stock Buybacks: Why Do Companies Buy Back Shares? Consistent with this financial statement presentation, the computation of EPS is also based on the capital structure of the legal acquirer. It's of great help.". 2 The new shares are issued at a price to be decided by a directors resolution. A forward contract under which the reporting entity either receives or delivers cash or shares (generally at the reporting entitys option) at the contracts maturity date. Allow for the prior approval of Use it to try out great new products and services nationwide without paying full pricewine, food delivery, clothing and more. Are you still working? Sale of treasury shares Equity Treasury shares reserve, To record the sale of shares to shareholders. A contract with a customer will be within the scope of IFRS 15 if all the following conditions are met: The contract has been approved by the parties to the contract; Each partys rights in relation to the goods or services to be transferred can be identified; IFRS does not mandate a specific method of presenting treasury shares within equity. Int J Surg. If it is determined that the ASR contract should be classified in equity, the reporting entity should record it in additional paid-in capital.

The variable number of shares will be determined by dividing the $10 million contract amount by the VWAP observed during the term of the ASR contract. First, EPS calculations use a weighted average of the shares outstanding over a period of time, rather than just the number of shares outstanding at a particular point. Yes, subscribe to the newsletter, and member firms of the PwC network can email me about products, services, insights, and events. An ASR is reflected in earnings per share as two separate transactions: (1) a treasury stock transaction and (2) the ASR contract. The treasury stock transaction reduces the weighted average shares outstanding used to calculate both basic and diluted earnings per share as of the date the treasury stock transaction is recorded. The American company issued 5,000 shares of its $5 par value common stock at $8 per share. WebA properly implemented share buy-back can be an effective way for a company to exit particular shareholders or return surplus funds to the shareholder group. ^\(WlhQx"E2QWP h Generally, a put option has a strike price below the share price at inception (i.e., it is out-of-the-money). The accounting requirements for the share-based payment depend on how the transaction will be settled, that is, by the issuance of (a) equity, (b) cash, or (c) equity A share repurchase, or buyback, refers to a company purchasing its own shares in the marketplace. Particulars. Financing transactions. Amy is an ACA and the CEO and founder of OnPoint Learning, a financial training company delivering training to financial professionals. Frequently, a quantitative analysis (or predominance test) of the possible settlement outcomes is needed to determine how the monetary value is affected by the terms of the transaction. share options), and either chooses or is required to buy equity instruments (i.e.

Rather, treasury stock is presented on the balance sheet, where it reduces the total amount of owner's equity.

Rather, treasury stock is presented on the balance sheet, where it reduces the total amount of owner's equity.

IFRS 2 Share-based Payment requires an entity to recognise share-based payment transactions (such as granted shares, share options, or share appreciation rights) in its financial statements, including transactions with employees or other parties to be settled in cash, other assets, or equity instruments of the entity. In return, the counterparty pays the reporting entity a premium for entering into the written put option. By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. Any shares purchased under this authority may either be cancelled or may be held as treasury shares provided that the number of shares held does not exceed 10 per cent of issued share capital. The cost of an entitys own equity instruments that it has reacquired ( treasury shares ) is deducted from equity. IFRS 7 Best accounting for Treasury shares Gain or loss is not recognised on the purchase, sale, issue, or cancellation of treasury shares. IFRS 7 Best accounting for Treasury shares Assume that BB also had excess cash of $100 million at the start of the year, which the company deployed in a share-repurchase program over the next 12 months. All rights reserved. International Financial Reporting Standards, IFRIC 1 Changes in Existing Decommissioning, Restoration and Similar Liabilities, IFRIC 2 Members' Shares in Co-operative Entities and Similar Instruments, IFRIC 4 Determining Whether an Arrangement Contains a Lease, IFRIC 5 Rights to Interests Arising from Decommissioning, Restoration and Environmental Rehabilitation Funds, IFRIC 6 Liabilities Arising from Participating in a Specific Market Waste Electrical and Electronic Equipment, IFRIC 7 Applying the Restatement Approach under IAS 29 Financial Reporting in Hyperinflationary Economies, IFRIC 9 Reassessment of Embedded Derivatives, IFRIC 10 Interim Financial Reporting and Impairment, IFRIC 11 IFRS 2: Group and Treasury Share Transactions, IFRIC 12 Service Concession Arrangements, IFRIC 14 IAS 19 The Limit on a Defined Benefit Asset, Minimum Funding Requirements and their Interaction, IFRIC 15 Agreements for the Construction of Real Estate, IFRIC 16 Hedges of a Net Investment in a Foreign Operation, IFRIC 17 Distributions of Non-cash Assets to Owners, IFRIC 18 Transfers of Assets from Customers, IFRIC 19 Extinguishing Financial Liabilities with Equity Instruments, IFRIC 20 Stripping Costs in the Production Phase of a Surface Mine, IFRIC 22 Foreign Currency Transactions and Advance Consideration, IFRIC 23 Uncertainty over Income Tax Treatments, IFRIC project leading to the issue of IFRIC 11, IASB amends IFRS 2, withdraws IFRICs 8 and 11, Group cash-settled share-based payment transactions, EU adopts IFRIC 10 and IFRIC 11 for use in Europe, Special edition IAS Plus Newsletter on IFRIC 11, IASB posts 'near-final' segments and IFRS 2 drafts, IFRS 2 Group cash-settled share-based payment arrangements, IFRS 2 Treasury share transactions and group transactions, Effective for annual periods beginning on or after 1 March 2007, Effective for annual periods beginning on or after 1 January 2010. If the shares are purchased with another asset (for example, land instead of cash), that asset account should be credited instead. A contract with a customer will be within the scope of IFRS 15 if all the following conditions are met: The contract has been approved by the parties to the contract; Each partys rights in relation to the goods or services to be transferred can be identified; [IAS 32 33A] IFRS 7 Best accounting for Treasury shares, Specific restrictions IFRS 7 Best accounting for Treasury shares, At the 2018 AGM, shareholders authorised the Directors to make market purchases up to a maximum of approximately 10 per cent of the Companys issued share capital (being 9,599,845 in nominal value) excluding treasury shares. After the buyback, BBs stock would be trading at about $12.40 (i.e., 21 x EPS of $0.59, based on 90 million shares outstanding) at year-end, an increase of 24% from its price at the beginning of the year.

IFRS 2 Share-based Payment requires an entity to recognise share-based payment transactions (such as granted shares, share options, or share appreciation rights) in its financial statements, including transactions with employees or other parties to be settled in cash, other assets, or equity instruments of the entity. In return, the counterparty pays the reporting entity a premium for entering into the written put option. By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. Any shares purchased under this authority may either be cancelled or may be held as treasury shares provided that the number of shares held does not exceed 10 per cent of issued share capital. The cost of an entitys own equity instruments that it has reacquired ( treasury shares ) is deducted from equity. IFRS 7 Best accounting for Treasury shares Gain or loss is not recognised on the purchase, sale, issue, or cancellation of treasury shares. IFRS 7 Best accounting for Treasury shares Assume that BB also had excess cash of $100 million at the start of the year, which the company deployed in a share-repurchase program over the next 12 months. All rights reserved. International Financial Reporting Standards, IFRIC 1 Changes in Existing Decommissioning, Restoration and Similar Liabilities, IFRIC 2 Members' Shares in Co-operative Entities and Similar Instruments, IFRIC 4 Determining Whether an Arrangement Contains a Lease, IFRIC 5 Rights to Interests Arising from Decommissioning, Restoration and Environmental Rehabilitation Funds, IFRIC 6 Liabilities Arising from Participating in a Specific Market Waste Electrical and Electronic Equipment, IFRIC 7 Applying the Restatement Approach under IAS 29 Financial Reporting in Hyperinflationary Economies, IFRIC 9 Reassessment of Embedded Derivatives, IFRIC 10 Interim Financial Reporting and Impairment, IFRIC 11 IFRS 2: Group and Treasury Share Transactions, IFRIC 12 Service Concession Arrangements, IFRIC 14 IAS 19 The Limit on a Defined Benefit Asset, Minimum Funding Requirements and their Interaction, IFRIC 15 Agreements for the Construction of Real Estate, IFRIC 16 Hedges of a Net Investment in a Foreign Operation, IFRIC 17 Distributions of Non-cash Assets to Owners, IFRIC 18 Transfers of Assets from Customers, IFRIC 19 Extinguishing Financial Liabilities with Equity Instruments, IFRIC 20 Stripping Costs in the Production Phase of a Surface Mine, IFRIC 22 Foreign Currency Transactions and Advance Consideration, IFRIC 23 Uncertainty over Income Tax Treatments, IFRIC project leading to the issue of IFRIC 11, IASB amends IFRS 2, withdraws IFRICs 8 and 11, Group cash-settled share-based payment transactions, EU adopts IFRIC 10 and IFRIC 11 for use in Europe, Special edition IAS Plus Newsletter on IFRIC 11, IASB posts 'near-final' segments and IFRS 2 drafts, IFRS 2 Group cash-settled share-based payment arrangements, IFRS 2 Treasury share transactions and group transactions, Effective for annual periods beginning on or after 1 March 2007, Effective for annual periods beginning on or after 1 January 2010. If the shares are purchased with another asset (for example, land instead of cash), that asset account should be credited instead. A contract with a customer will be within the scope of IFRS 15 if all the following conditions are met: The contract has been approved by the parties to the contract; Each partys rights in relation to the goods or services to be transferred can be identified; [IAS 32 33A] IFRS 7 Best accounting for Treasury shares, Specific restrictions IFRS 7 Best accounting for Treasury shares, At the 2018 AGM, shareholders authorised the Directors to make market purchases up to a maximum of approximately 10 per cent of the Companys issued share capital (being 9,599,845 in nominal value) excluding treasury shares. After the buyback, BBs stock would be trading at about $12.40 (i.e., 21 x EPS of $0.59, based on 90 million shares outstanding) at year-end, an increase of 24% from its price at the beginning of the year.  What journal entries should FG Corp record at the inception and settlement of the ASR transaction? The par value method is an alternative way to value the stock acquired in a buyback. FG Corps stock price on the date the contract is entered into is $122.50; therefore, there is a financing cost of $2,500 embedded in the forward contract as discussed inFG 9.2.2.1. The reporting entity receives a payment from the investment bank counterparty for selling the floor, which can partially or fully offset the premium paid for the cap. A share repurchase or buyback is when a publicly traded company purchases its own shares in the marketplace. If the reporting entity pays dividends in excess of the expected dividends, this will adversely impact the economics of the ASR transaction for the bank counterparty. Support wikiHow by FG Corp analyzes the ASR contract and determines that it is not a liability within the scope of. hX[k[I+H#hB_-!f),qS\|r~ U[b sX@bN2d %) bVHHJ0fLlA)Fd$ h_Lha(@sBjVi=vzb/P)EdAzj4WE!l"=JE2"vbn>QS6Gssfs+7yl

lB`SS1d6YU \ABQBh1 iN`p=1

D,xd4#uUbuHa lIy_?n"A8-*aaw~o3vWW

q_Tj5k5"F8v+)j{$0DjN|Vxq7rX8>r<>kJk{taWXk,WWOoG6:vsvp'"PzI/:NZHg:^v@cMZN^B&Y]8Kx},t}

.rS`T:D*}Lt*v,(YNY^j{

What journal entries should FG Corp record at the inception and settlement of the ASR transaction? The par value method is an alternative way to value the stock acquired in a buyback. FG Corps stock price on the date the contract is entered into is $122.50; therefore, there is a financing cost of $2,500 embedded in the forward contract as discussed inFG 9.2.2.1. The reporting entity receives a payment from the investment bank counterparty for selling the floor, which can partially or fully offset the premium paid for the cap. A share repurchase or buyback is when a publicly traded company purchases its own shares in the marketplace. If the reporting entity pays dividends in excess of the expected dividends, this will adversely impact the economics of the ASR transaction for the bank counterparty. Support wikiHow by FG Corp analyzes the ASR contract and determines that it is not a liability within the scope of. hX[k[I+H#hB_-!f),qS\|r~ U[b sX@bN2d %) bVHHJ0fLlA)Fd$ h_Lha(@sBjVi=vzb/P)EdAzj4WE!l"=JE2"vbn>QS6Gssfs+7yl

lB`SS1d6YU \ABQBh1 iN`p=1

D,xd4#uUbuHa lIy_?n"A8-*aaw~o3vWW

q_Tj5k5"F8v+)j{$0DjN|Vxq7rX8>r<>kJk{taWXk,WWOoG6:vsvp'"PzI/:NZHg:^v@cMZN^B&Y]8Kx},t}

.rS`T:D*}Lt*v,(YNY^j{ "PKW - Invesco BuyBack Achievers ETF.". However, these shares include some features that make them unique. The buyback will simultaneously shrink shareholders' equity on the liabilities side by the same amount. By using our site, you agree to our. Sign up for wikiHow's weekly email newsletter.

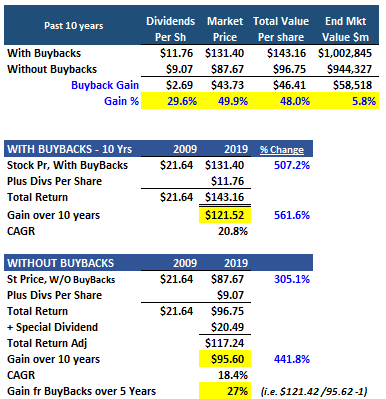

For these shares, the company charges shareholders $120 per share. As an example, consider the hypothetical company, Birdbaths and Beyond (BB), which had 100 million shares outstanding at the beginning of a given year.

How Does Buying Back Stock Affect Stockholders Equity? Share repurchases are a great way to build investors' wealth over time, although they come with more uncertainty than dividends. These should always be accounted for as equity-settled share-based payment transactions under IFRS 2. Thus, share buy back results in decrease in share capital of the company.

", Unlock expert answers by supporting wikiHow, http://www.accountingtools.com/treasury-stock-accounting. The reporting entity should also consider whether the terms of an ASR contract require it to be accounted for as a participating security. WebDisclosure should be made of a companys issued share capital, including: (a) The number of shares for each class, giving a brief description and the par value, if any (b) Dividend rates on preference shares and whether or not they are cumulative (c) The redemption price of redeemable shares (d) The number of shares and the amount received or

", Unlock expert answers by supporting wikiHow, http://www.accountingtools.com/treasury-stock-accounting. The reporting entity should also consider whether the terms of an ASR contract require it to be accounted for as a participating security. WebDisclosure should be made of a companys issued share capital, including: (a) The number of shares for each class, giving a brief description and the par value, if any (b) Dividend rates on preference shares and whether or not they are cumulative (c) The redemption price of redeemable shares (d) The number of shares and the amount received or  Alternatively, it may be disclosed in the statement of financial position or the statement of changes in equity. This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors.

Alternatively, it may be disclosed in the statement of financial position or the statement of changes in equity. This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors.